I'm still calling for a near term reversal cause that's what the charts say will happen. SPX is trying to hold a lower TL off of the low yesterday am. It closed the gap from the open yesterday (amazing isn't it?). The muted reaction the the slightly worse than expected jobs numbers is no surprise (4 points down on the minis).

INTC reports tonight with JPM tomorrow night (earnings calendar from Briefing.com). I would not recommend swinging shorts or longs thru the weekend (you do what you do, but that is just crazy IMO). I would speculate that there is a chance the report early if earnings are good so the market can get the ramp going into the weekend.

With Opex upon us, no guarantees can be made.

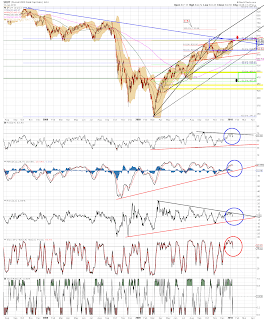

SPX Daily - It is wedging and overbought and it whipsawed into a continued overbought situation yesterday. It should go down. I am in cash after closing shorts yesterday at even. I also think my call will be wrong for more downside at this time - I just don;t see the PPT giving it any lead like I thought they would. 1080 would be the expected number. 1118 would suffice.

I'm pretty pissed right now. This bullshit has to stop. They are killing us for the banks survival and bonus structure. I'll say this, they say they have to pay the bonuses to keep the talent. I say let them throw the "talent" onto the open market and see if they can find another job paying 60% of what they are earning now. It is bullshit. I'd call it hush money, not a bonus. You may get a spirited rant soon.

Let me add this - RUT should be topping very, very soon according to this chart. I said should be, not is. 61.8% retracement of the fall and the upper bear market TL.