Quiet day on the earnings calendar. Marketwatch reports SocGen profit almost wiped out by $2 billion charge and Google may pack it in. Soc Gen is most interesting cause of the up coming reports from JPM and C.The most interesting thing to show up after the bell was Weekly ABC Consumer Confidence Plummets By 11% As Holiday Bills Arrive Following Weak Payrolls Number. I guess the consumer really does not matter any more based on the flat futures right now.

Hearings on the hill will be interesting today.

Bad news seems to be percolating to the top. Global tensions appear to be getting a little more edgier. Greece may just go under first (excluding Iceland of course). It is only a matter of time now before THE fall. I caution the shorts again about being over exuberant.

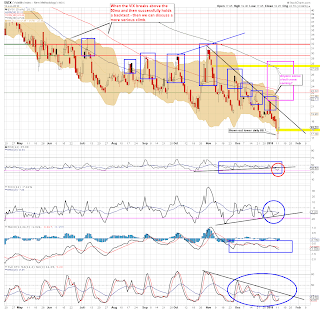

SPX daily short term - Overbought and either rolling over or it will remain embedded. I'm short from early yesterday and looking for a continuation. I am anticipating the indicators to make it to their bottoms, but cautioning about them remaining range bound and overbought. If we can get RSI under 50 this thing may get somewhere. 1118 to 1080 is initial target range. 1053 is the extreme right now.

SPX weekly - See the circle. The rounding top nearing the apex with two trendlines converging? DE sowed this a few months back and I'm not sure if he has brought it back out. That little pop above the TL's and circle bother me a little, but then again that may be part of a blow off top. I'm sticking to my guns that this is not the top, but we are near. I'll show you a chart tomorrow am that will show why I believe we have at least one more higher high to go.

Sure the VIX is ready to pop, but how many times have we seen this before? This is the 12th attempt at a meaningful erection for the VIX since May that I can count. I have speculated for a long time now that the VIX is irrelevant at this time. Fear/caution is rampant throughout the markets world wide based on the cash on the sidelines and investor sentiment surveys, but the VIX just bottomed at 17? It did take out the triangle target of 17.43 and blew out the lower BB. RSI tagged the pink bottom line and S Sto is about to break the trendline. It had a nice pop and should continue to rise. I'm looking for the 50/200ma's to get a little closer before I get too excited.

Remember, I am a permabear. I do believe the fall will come, just not yet. Sooner than later. This fall should be descent. I'm willing to give it down to 1053 at this point. I am willing to call this THE top as well if the form of the fall develops properly, but I am not seeing anything major just yet. I have a chart tomorrow that will show you why I think we have one more pop.

GL today.