I think gold is going to top temporarily this week.

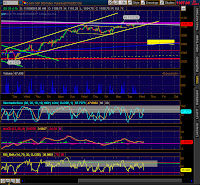

E - minis 60 m - Battle with top trendlines continues. See that yellow box? That is the 50 to 61% retracement zone and it runs nicely with the 1062 support and the lower (blue) P2 support line.

DXY 60m - Is it in a descending triangle? HERE is one of my big questions. If the minis are in a 2 down bouncing off of strong resistance it appears it will take a 3 (third wave) up to bust that. Do you see a three driver in the dollar chart? It is at support and wedging. The floor in the dollar has me a little timid in calling for a impulsive 3 up. Does the market and the dollar begin their dislocation soon?

SPX chart - The style is called Sunset and I will use this weekly chart to call the sun setting one the SPX. We're missing the divergence in CCI and a larger divergence in RSI IMO.

SPX 60m - Looks like a completed 5 waves up, and the divergences are there. 1081 to 1061 is the target range at this time. That will be refined as we go.

Index comparison chart - Art mentioned the Russell 2000 this am and stole my thunder. Can you say lag?

SPX daily - Day 7 in the blue box - Look for MACD hist to turn today (I thought it would turn yesterday.

UPDATES -

UNG - Pulling back. 60m chart looks bad, but the dailys look ok for now. Be careful and set your stops.

EUR/JPY- Should drive down to support at 131.

EUR/USD -Between support and resistance topping.

Gold - I think it is going to have a small pullback very soon. I'll do a post.

Oil - forming a base for a further push higher IMO.

Look for updates during the day.

If you are reading this post on another feed, please bookmark my blog and use it directly. Last night I was surfing my links and noticed that there are several sites that take the whole post and my readers with it. I have nothing against sharing, but stealing the whole post king of sucks. So bookmark me or give me a click. Thanks.

GL trading.