"Traders are bracing for another rough ride in markets this week, as the emerging markets continue to shakeout and the Fed is expected to announce another round of cuts to its easing program.

There are also about a quarter of the S&P 500 companies reporting earnings, including Apple Monday, Boeing and Facebook Wednesday, and Exxon Mobil and Google Thursday.

Several major economic reports are also expected, starting with new home sales Monday and durable goods Tuesday, while the first look at fourth-quarter GDP is expected Thursday."At the top I see Taper, AAPL and GDP - Looks to be another week full of lies and data manipulation to me. Nothing Will Deter Fed From Tapering This week - well maybe, but Wednesday will be a big day.

As for the SOTU Tuesday - LOL - like anyone really cares to hear more lies.

All this a near perfect cover for the capital controls issue that seems to be heating up. Now, let me remind you that capital controls means what you can or can not take out of a bank that is yours. Capital controls means that what's yours is now theirs to control. As I explained last week (and for the last three to four years) demand deposits does not mean you can go to a bank right now and get all your cash out. It mans they demand to keep and use your cash as they see fit and will give you an alloted amount, but you can not have it all.

An example of a real extreme form of capital control that HSBC is now using is, "As the BBC reported, customers attempting to withdraw £5,000 or more of their own money are being told they need to provide written documentation of what it will be used for, a new form of capital control" How nice. And if you think that's not happening here in the US, well, go try and get $10k out of your bank. They will tell you to schedule the withdrawal and come back next week.

Or try this one fresh off the wire - Bundesbank's Stunner To Broke Eurozone Nations: First "Bail In" Your Rich Citizens

"the Bundesbank said on Monday that countries about to go bankrupt should draw on the private wealth of their citizens through a one-off capital levy before asking other states for help."

STB's been telling you for years you need to be systematically removing your funds from their system (and then getting that out of the dollar and into alternative real assets). I certainly hope you are seriously considering this. If you think you are getting richer or protecting your retirement holding paper fiat currency or paper gold in their system I have a feeling you are sorely mistaken and will regret this one day.

And what would an STB post be without a false flag warning - they need one soon and a big one at that (or a war - either or both I'm sure is acceptable).

On to the lie -

This week has potential to start calmly ahead of the Fed, but also with all the earnings and GDP to come it could have a fair degree of volatility. I think chaos is starting to set in personally. So, about the pop this morning - Let's see - the NIKKEI was off 2.5% and the FTSE was off 1.25% and we're gonna open up a healthy 40 DOW points. Ah, living in the Matrix is so awesome. We're insulated from the rest of the world. We're independent. What happens there means nothing here/ LOL, the arrogance of our manipulated markets has no end.

SPX Daily - Below the 50dma, the lower BB and falling back into the black wedge is NOT where they want price to be especially considering the black wedge support is the line they must hold now at all cost.

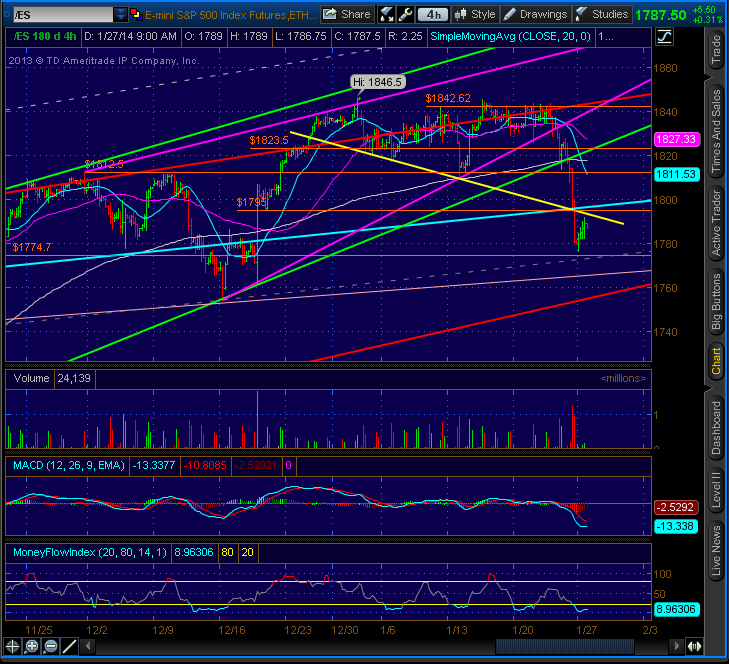

Minis 4hr - They took price into no mans land Friday below upper blue LT market resistance. Just below is my red line of death.

More to come below on specific levels above and below. This week is hard to get a finger on as they can turn it so many ways. If the capital controls issue persists or grows then there is serious trouble brewing. My best guess is the Fed tapers into an awesome (lie) GDP number Friday. Of course all this "recovery" and positive spin will be furthered by potential price pumping.

Have a good week.

GL and GB!

No comments:

Post a Comment

Keep it civil and respectful to others.