You know the drill, share the love and the knowledge.

August of 2013 was the last red month. Last year there were only two, so bears are getting their work done early this year. They tend to come in bunches or pairs.

Not much to comment on that was not covered in the awesome comment section this week. You folks really kick ass. Not sure why this is not one of the top blogs for information on the new. I kinda like it under our little rock and think I will keep it that way.

Always the possibility of a FF at the Super Bowl, so be ready just in case. In the championship game I went against the Broncos cause of their D. I still contend Brady had one of his worst games ever. I'm rooting for the Broncos cause of Baily and Moreno (Bulldawgs), but I'm going to have to pick the better D and go with Seattle for the W. I also want PM to win another, but I think that Seattle D is just too much and RW's scrambling may be the ultimate difference.

Minis 60m -Minis fell and tagged my red diagonal of death perfectly and reversed for now. That's either it for the correction or things get a lot worse. Next stop is near 1700 and then 1630. I'm not sure they can revover if this diagonal goes, and I believe they know that. The STB red diagonal of death was as low as I was willing to go on the last two tumbles. Can they hold it again? We will soon know.

Have a great weekend.

GL and GB

Friday, January 31, 2014

Morning Charts 01/31/14 SPX /ES

I suggest you read 32 Alarming Facts Missing From Obama's State Of The Union Address if you think there is any sort of recovery happening. Among my favorite facts on the list -

#6 Barack Obama says that the unemployment rate has declined to 6.7 percent, but if the labor force participation rate was at the long-term average it would actually be approximately 11.5 percent, and it has stayed at about that level since the end of the last recession.

#7 While Barack Obama has been in the White House, the number of Americans on food stamps has gone from 32 million to 47 million.

#8 While Barack Obama has been in the White House, the percentage of working age Americans that are actually working has declined from 60.6 percent to 58.6 percent.

#9 While Barack Obama has been in the White House, the average duration of unemployment in the United States has risen from 19.8 weeks to 37.1 weeks.

#10 While Barack Obama has been in the White House, social benefits as a percentage of real disposable income has risen from about 17 percent to nearly 21 percent.

#11 While Barack Obama has been in the White House, the rate of homeownership in the United States has fallen to levels that we have not seen in nearly two decades.

#12 While Barack Obama has been in the White House, median household income in the United States has fallen for five years in a row.

#13 While Barack Obama has been in the White House, the average cost of a gallon of gasoline has gone from $1.85 to $3.27.

#14 At the end of Barack Obama's first year in office, our yearly trade deficit with China was 226 billion dollars. Now it is over 300 billion dollars.

Sadly those facts are all actually worse than stated. Those facts above are inflated. Yes, our puppet in chief has done a fantabulous job destroying the country he deplores. The good news for him is the idiot sheeple voted him back in, and he still has three years left to complete his mission. At this pace he may need only one more year and the job is already 90% complete. Is it any wonder democraps are fleeing office and distancing themselves from this tyrant? The better news for him, the minimum wage increase, whammo! secure his expanding voter base - yes the idiots he continues to push futher into poverty. Amazing.

On to the lie -

Minis Daily - STB red line of death tagged this morning.

Minis Daily - Same chart just zoomed in - there's no support to the 200dma at 1705 and nothing below that to 1625. Once this lets go, I don't think they can stop it until major support levels. Thus, it's called the STB red line of death.

If this cracks, it should be all over. A move to the 1705 area and a backtest of the red line of death near the 1800 area and then poof! is how I would see this playing out. That is if they can stop it at the 1705 level once it starts falling. I've often mentioned that when the gates open EVERYONE will head for the exits at the same time.

It's not time to panic quite yet, but that moment could happen at a moments notice. They have not allowed price to enter the danger zone, but they sure are as close to it as they can allow. You name it and it's bad right now. From EM to earnings to whatever you want to look at here or globally. It is a miracle the markets are where they are now. As Soup said yesterday, no one wants to leave the party, and they all should have gone home already.

This brings me back to the False Flag discussion - Snipers at the Super Bowl? Yes, really - and then there is Sochi - two prime opportunities for the "terrorists" to hit us at a moment when the governments need the greatest distraction. The next FF will not be a shooting at a school, it's gonna be massive. If the SB was not in NYC, I'd be thinking a large event. Pay attention to see if any dignitaries are warned not to go to the SB.

More to come below.

Have a good weekend.

GL and GB!

#6 Barack Obama says that the unemployment rate has declined to 6.7 percent, but if the labor force participation rate was at the long-term average it would actually be approximately 11.5 percent, and it has stayed at about that level since the end of the last recession.

#7 While Barack Obama has been in the White House, the number of Americans on food stamps has gone from 32 million to 47 million.

#8 While Barack Obama has been in the White House, the percentage of working age Americans that are actually working has declined from 60.6 percent to 58.6 percent.

#9 While Barack Obama has been in the White House, the average duration of unemployment in the United States has risen from 19.8 weeks to 37.1 weeks.

#10 While Barack Obama has been in the White House, social benefits as a percentage of real disposable income has risen from about 17 percent to nearly 21 percent.

#11 While Barack Obama has been in the White House, the rate of homeownership in the United States has fallen to levels that we have not seen in nearly two decades.

#12 While Barack Obama has been in the White House, median household income in the United States has fallen for five years in a row.

#13 While Barack Obama has been in the White House, the average cost of a gallon of gasoline has gone from $1.85 to $3.27.

#14 At the end of Barack Obama's first year in office, our yearly trade deficit with China was 226 billion dollars. Now it is over 300 billion dollars.

Sadly those facts are all actually worse than stated. Those facts above are inflated. Yes, our puppet in chief has done a fantabulous job destroying the country he deplores. The good news for him is the idiot sheeple voted him back in, and he still has three years left to complete his mission. At this pace he may need only one more year and the job is already 90% complete. Is it any wonder democraps are fleeing office and distancing themselves from this tyrant? The better news for him, the minimum wage increase, whammo! secure his expanding voter base - yes the idiots he continues to push futher into poverty. Amazing.

On to the lie -

Minis Daily - STB red line of death tagged this morning.

Minis Daily - Same chart just zoomed in - there's no support to the 200dma at 1705 and nothing below that to 1625. Once this lets go, I don't think they can stop it until major support levels. Thus, it's called the STB red line of death.

If this cracks, it should be all over. A move to the 1705 area and a backtest of the red line of death near the 1800 area and then poof! is how I would see this playing out. That is if they can stop it at the 1705 level once it starts falling. I've often mentioned that when the gates open EVERYONE will head for the exits at the same time.

It's not time to panic quite yet, but that moment could happen at a moments notice. They have not allowed price to enter the danger zone, but they sure are as close to it as they can allow. You name it and it's bad right now. From EM to earnings to whatever you want to look at here or globally. It is a miracle the markets are where they are now. As Soup said yesterday, no one wants to leave the party, and they all should have gone home already.

This brings me back to the False Flag discussion - Snipers at the Super Bowl? Yes, really - and then there is Sochi - two prime opportunities for the "terrorists" to hit us at a moment when the governments need the greatest distraction. The next FF will not be a shooting at a school, it's gonna be massive. If the SB was not in NYC, I'd be thinking a large event. Pay attention to see if any dignitaries are warned not to go to the SB.

More to come below.

Have a good weekend.

GL and GB!

Thursday, January 30, 2014

Morning Charts 1/30/14 SPX /ES

STB pretty disgusted with all the news and the fact that no one can even utter anything that is anywhere near the truth anymore. Even more disgusting the fact that most sheeple just roll along as if all will be well in the end and the typical American fairytale ending will come as it always has. The sheeple's ignorance, arrogance and incompetence is shining more brightly now than ever before.

We've recently moved from (coincidentally with BB and TG's departure) total control and complete manipulation to a situation where control is fleeting and chaos is starting to rule. The Fed's BS taper "all is well" we're recovering was the final straw for those on the sidelines that would not admit but always knew, without QE we we're nothing.

So here we are finally nearing the end. The train is about to come out of the tunnel and find at the end there are no more tracks and there is a cliff waiting. No more bridges are waiting to save this train from falling to its doom. Miracles will be fleeting and not on demand. Bottom line is they can only fight rates now and not the market as well. They have to prioritize, cause if rates rise, it will truly be game over for us all.

Domestic issues aside, the global scene is in complete meltdown, but the MSM is not allowed to report on that or let you know just how dire the situation is across the globe. You see, the Fed (er we the American taxpayer) have been supporting the global ponzi all along, and we can not do that anymore either. The bail-in messages are everywhere now. The global economic meltdown is in its final throws.

Wake up STB to the reality and do something to protect yourself now if you have not. Protect your family and funds. My suggestion is prep like hell if you have not and get your money out of the markets and the dollar. Capital controls are coming as well as central bank theft. Remember the dollar is called a FRN. They can do as they wish with them. Be prepared for that.

On to the lie -

Still reporting from home, so the travel charts are all I have. They have worked fine and are only slightly different from the work computer.

Bottom line is we're sitting on a cliff that has very few points that would stop our fall if we were to go over the edge. At this level or diagonal, the Fed has been able to contain things in the past and consistently make the markets rise to new heights. Price is literally sitting on STB's red line of death that I've been discussing for months now.

Looking at the charts there may be one last support diagonal below that they may be able to defend, but is 1757 goes (the red line of death on the work computer) I'll call a top and be done with it. As discussed, the irony I face having made my first swing trade in close to two years at the close on Wednesday the 15th is disturbing. I made the trade on principle. It was the perfect technical top at the end of a very long ride.

Why not call a top? Simple, I am ridiculously fearful of the Fed and it's manipulation. As I have said over and over, this game is not about nailing the top anymore but getting that final trade right. Nailing the top is not important. Don't fret missing the first one or even 5%, there will be PLENTY more where that came from.

Minis Weekly - Simple, yellow, beige, yellow and blue - those diagonals are all there is that's left.

Minis Daily - Red line of death. the diagonal that started the red rising wedge that began off the November 1012 lows is it.

More to come below. I'm at home. so I'll be in and out today.

Have a good day.

GL and GB!

We've recently moved from (coincidentally with BB and TG's departure) total control and complete manipulation to a situation where control is fleeting and chaos is starting to rule. The Fed's BS taper "all is well" we're recovering was the final straw for those on the sidelines that would not admit but always knew, without QE we we're nothing.

So here we are finally nearing the end. The train is about to come out of the tunnel and find at the end there are no more tracks and there is a cliff waiting. No more bridges are waiting to save this train from falling to its doom. Miracles will be fleeting and not on demand. Bottom line is they can only fight rates now and not the market as well. They have to prioritize, cause if rates rise, it will truly be game over for us all.

Domestic issues aside, the global scene is in complete meltdown, but the MSM is not allowed to report on that or let you know just how dire the situation is across the globe. You see, the Fed (er we the American taxpayer) have been supporting the global ponzi all along, and we can not do that anymore either. The bail-in messages are everywhere now. The global economic meltdown is in its final throws.

Wake up STB to the reality and do something to protect yourself now if you have not. Protect your family and funds. My suggestion is prep like hell if you have not and get your money out of the markets and the dollar. Capital controls are coming as well as central bank theft. Remember the dollar is called a FRN. They can do as they wish with them. Be prepared for that.

On to the lie -

Still reporting from home, so the travel charts are all I have. They have worked fine and are only slightly different from the work computer.

Bottom line is we're sitting on a cliff that has very few points that would stop our fall if we were to go over the edge. At this level or diagonal, the Fed has been able to contain things in the past and consistently make the markets rise to new heights. Price is literally sitting on STB's red line of death that I've been discussing for months now.

Looking at the charts there may be one last support diagonal below that they may be able to defend, but is 1757 goes (the red line of death on the work computer) I'll call a top and be done with it. As discussed, the irony I face having made my first swing trade in close to two years at the close on Wednesday the 15th is disturbing. I made the trade on principle. It was the perfect technical top at the end of a very long ride.

Why not call a top? Simple, I am ridiculously fearful of the Fed and it's manipulation. As I have said over and over, this game is not about nailing the top anymore but getting that final trade right. Nailing the top is not important. Don't fret missing the first one or even 5%, there will be PLENTY more where that came from.

Minis Weekly - Simple, yellow, beige, yellow and blue - those diagonals are all there is that's left.

Minis Daily - Red line of death. the diagonal that started the red rising wedge that began off the November 1012 lows is it.

More to come below. I'm at home. so I'll be in and out today.

Have a good day.

GL and GB!

Wednesday, January 29, 2014

Morning Charts 01/29/14 SPX /ES

All I have to say is MyRA. The first step to retirement plan confiscation and domination by the government. I would not be surprised if this is completed under the current

Fed day.

Earnings.

China Trust

Emerging Markets (incl Turkey)

GDP Friday.

All that and I'm at home for a snow day for STB today, so at home with all the distractions. Got about 2 inches of snow last night. Very nice.

On to the lie -

Minis - The travel STB computer has the STB red line of death drawn a bit higher than the one on the work computer. At work it's down near 1757. I'll have to see if I can find where they are different. Either way, price is in a serious danger zone.

Have a good day.

GL and GB!

Fed day.

Earnings.

China Trust

Emerging Markets (incl Turkey)

GDP Friday.

All that and I'm at home for a snow day for STB today, so at home with all the distractions. Got about 2 inches of snow last night. Very nice.

On to the lie -

Minis - The travel STB computer has the STB red line of death drawn a bit higher than the one on the work computer. At work it's down near 1757. I'll have to see if I can find where they are different. Either way, price is in a serious danger zone.

Have a good day.

GL and GB!

Tuesday, January 28, 2014

Morning Charts 1/28/14 SPX /ES

Fed tomorrow but Otyrant tonight. As usual, I will not be watching. Most here know I can not stand to see the person much less hear his voice. Yes, that person who hates America, everything it stands for and wants to destroy this country will address the nation tonight. He's going to tell us what he will do - legal or not. At least we know he will not be lying when he tells us he"s going to use the power of his office to do whatever the heck he wants to.

So, do you think the market will close red on the day Ofascist speaks to the nation? Impossible! Will any bad news hit the wires? Impossible! It will be smooth sailing all the way to the bully pulpit where his puppetness will throw down the law as only he can. Is Tzar Obummer an imperial president? Read this about the person who believes he's king.

On to the lie -

Ontichrist is all that matters today. Then the Fed and taper tomorrow. The Fed is a big deal, a really big deal. Maybe the biggest deal will be GDP Friday. The Fed's coming action may be somewhat priced in, but GDP is not. Let's see if we can locate the clues for who leaked what and when, then follow their lead.

SPX Daily - 50dma, 1810 and upper black wedge resistance are all now in the way of a rising price. Markets are somewhat NT oversold, but in the grand scheme of things still way overvalued. There is nothing in the indicators I see that indicates a rebound quite yet, not that they are necessary in this rigged game.

Minis 60m - Price remains perilously close to my red line of death (1755). AAPL took a bite out of the rebound party this morning (went as low as 500 AH). One more of those from FB or GOOG this week and the party may be over. They are not out of the woods just yet, but they are very close to a point I believe they must hold or else.

Minis Daily - Look at the hole they created below the red support. Nothing there to stop a fall to 1701 and the 200dma. After that, very little down to 1630. We're talking verge of epic collapse.

More to come below.

Have a good day.

GL and GB!

So, do you think the market will close red on the day Ofascist speaks to the nation? Impossible! Will any bad news hit the wires? Impossible! It will be smooth sailing all the way to the bully pulpit where his puppetness will throw down the law as only he can. Is Tzar Obummer an imperial president? Read this about the person who believes he's king.

On to the lie -

Ontichrist is all that matters today. Then the Fed and taper tomorrow. The Fed is a big deal, a really big deal. Maybe the biggest deal will be GDP Friday. The Fed's coming action may be somewhat priced in, but GDP is not. Let's see if we can locate the clues for who leaked what and when, then follow their lead.

SPX Daily - 50dma, 1810 and upper black wedge resistance are all now in the way of a rising price. Markets are somewhat NT oversold, but in the grand scheme of things still way overvalued. There is nothing in the indicators I see that indicates a rebound quite yet, not that they are necessary in this rigged game.

Minis 60m - Price remains perilously close to my red line of death (1755). AAPL took a bite out of the rebound party this morning (went as low as 500 AH). One more of those from FB or GOOG this week and the party may be over. They are not out of the woods just yet, but they are very close to a point I believe they must hold or else.

Minis Daily - Look at the hole they created below the red support. Nothing there to stop a fall to 1701 and the 200dma. After that, very little down to 1630. We're talking verge of epic collapse.

More to come below.

Have a good day.

GL and GB!

Monday, January 27, 2014

Morning Charts 01/27/14 SPX /ES

This post from CNBS best describes the local events that will cause us some headaches this week - Anxious week ahead for markets

As for the SOTU Tuesday - LOL - like anyone really cares to hear more lies.

All this a near perfect cover for the capital controls issue that seems to be heating up. Now, let me remind you that capital controls means what you can or can not take out of a bank that is yours. Capital controls means that what's yours is now theirs to control. As I explained last week (and for the last three to four years) demand deposits does not mean you can go to a bank right now and get all your cash out. It mans they demand to keep and use your cash as they see fit and will give you an alloted amount, but you can not have it all.

An example of a real extreme form of capital control that HSBC is now using is, "As the BBC reported, customers attempting to withdraw £5,000 or more of their own money are being told they need to provide written documentation of what it will be used for, a new form of capital control" How nice. And if you think that's not happening here in the US, well, go try and get $10k out of your bank. They will tell you to schedule the withdrawal and come back next week.

Or try this one fresh off the wire - Bundesbank's Stunner To Broke Eurozone Nations: First "Bail In" Your Rich Citizens

STB's been telling you for years you need to be systematically removing your funds from their system (and then getting that out of the dollar and into alternative real assets). I certainly hope you are seriously considering this. If you think you are getting richer or protecting your retirement holding paper fiat currency or paper gold in their system I have a feeling you are sorely mistaken and will regret this one day.

And what would an STB post be without a false flag warning - they need one soon and a big one at that (or a war - either or both I'm sure is acceptable).

On to the lie -

This week has potential to start calmly ahead of the Fed, but also with all the earnings and GDP to come it could have a fair degree of volatility. I think chaos is starting to set in personally. So, about the pop this morning - Let's see - the NIKKEI was off 2.5% and the FTSE was off 1.25% and we're gonna open up a healthy 40 DOW points. Ah, living in the Matrix is so awesome. We're insulated from the rest of the world. We're independent. What happens there means nothing here/ LOL, the arrogance of our manipulated markets has no end.

SPX Daily - Below the 50dma, the lower BB and falling back into the black wedge is NOT where they want price to be especially considering the black wedge support is the line they must hold now at all cost.

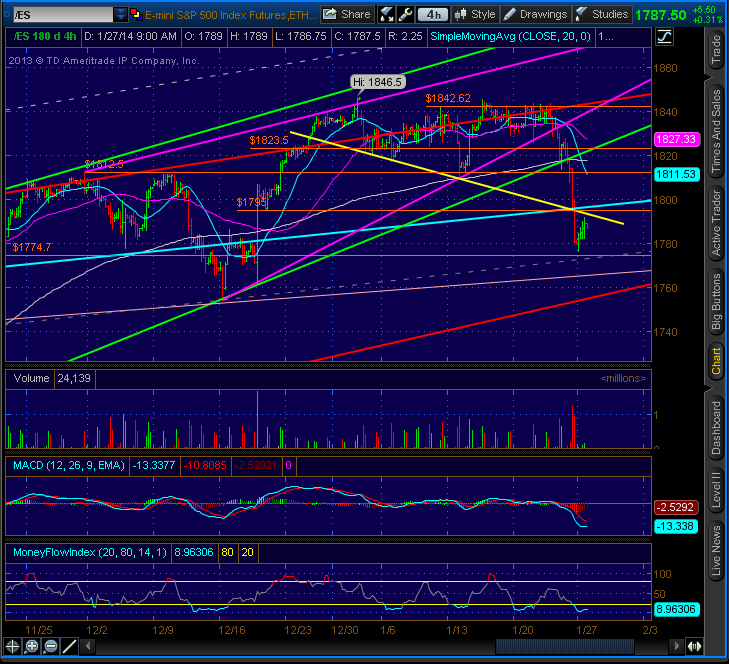

Minis 4hr - They took price into no mans land Friday below upper blue LT market resistance. Just below is my red line of death.

More to come below on specific levels above and below. This week is hard to get a finger on as they can turn it so many ways. If the capital controls issue persists or grows then there is serious trouble brewing. My best guess is the Fed tapers into an awesome (lie) GDP number Friday. Of course all this "recovery" and positive spin will be furthered by potential price pumping.

Have a good week.

GL and GB!

"Traders are bracing for another rough ride in markets this week, as the emerging markets continue to shakeout and the Fed is expected to announce another round of cuts to its easing program.

There are also about a quarter of the S&P 500 companies reporting earnings, including Apple Monday, Boeing and Facebook Wednesday, and Exxon Mobil and Google Thursday.

Several major economic reports are also expected, starting with new home sales Monday and durable goods Tuesday, while the first look at fourth-quarter GDP is expected Thursday."At the top I see Taper, AAPL and GDP - Looks to be another week full of lies and data manipulation to me. Nothing Will Deter Fed From Tapering This week - well maybe, but Wednesday will be a big day.

As for the SOTU Tuesday - LOL - like anyone really cares to hear more lies.

All this a near perfect cover for the capital controls issue that seems to be heating up. Now, let me remind you that capital controls means what you can or can not take out of a bank that is yours. Capital controls means that what's yours is now theirs to control. As I explained last week (and for the last three to four years) demand deposits does not mean you can go to a bank right now and get all your cash out. It mans they demand to keep and use your cash as they see fit and will give you an alloted amount, but you can not have it all.

An example of a real extreme form of capital control that HSBC is now using is, "As the BBC reported, customers attempting to withdraw £5,000 or more of their own money are being told they need to provide written documentation of what it will be used for, a new form of capital control" How nice. And if you think that's not happening here in the US, well, go try and get $10k out of your bank. They will tell you to schedule the withdrawal and come back next week.

Or try this one fresh off the wire - Bundesbank's Stunner To Broke Eurozone Nations: First "Bail In" Your Rich Citizens

"the Bundesbank said on Monday that countries about to go bankrupt should draw on the private wealth of their citizens through a one-off capital levy before asking other states for help."

STB's been telling you for years you need to be systematically removing your funds from their system (and then getting that out of the dollar and into alternative real assets). I certainly hope you are seriously considering this. If you think you are getting richer or protecting your retirement holding paper fiat currency or paper gold in their system I have a feeling you are sorely mistaken and will regret this one day.

And what would an STB post be without a false flag warning - they need one soon and a big one at that (or a war - either or both I'm sure is acceptable).

On to the lie -

This week has potential to start calmly ahead of the Fed, but also with all the earnings and GDP to come it could have a fair degree of volatility. I think chaos is starting to set in personally. So, about the pop this morning - Let's see - the NIKKEI was off 2.5% and the FTSE was off 1.25% and we're gonna open up a healthy 40 DOW points. Ah, living in the Matrix is so awesome. We're insulated from the rest of the world. We're independent. What happens there means nothing here/ LOL, the arrogance of our manipulated markets has no end.

SPX Daily - Below the 50dma, the lower BB and falling back into the black wedge is NOT where they want price to be especially considering the black wedge support is the line they must hold now at all cost.

Minis 4hr - They took price into no mans land Friday below upper blue LT market resistance. Just below is my red line of death.

More to come below on specific levels above and below. This week is hard to get a finger on as they can turn it so many ways. If the capital controls issue persists or grows then there is serious trouble brewing. My best guess is the Fed tapers into an awesome (lie) GDP number Friday. Of course all this "recovery" and positive spin will be furthered by potential price pumping.

Have a good week.

GL and GB!

Friday, January 24, 2014

Open Weekend Post 01/25-26/14

You know the drill, share the love and the knowledge.

So, what's up (or down) with the market this week? Are we bears just dreaming? Are they enticing the shorts to line up for another slaughter? Are the finally really in trouble? Is this the beginning of the end? Is this just the LEH incident before the last bull run to yet another improbable ATH? So many thoughts.

If you see it, share it.

Minis 4hr - OK, brand spanking new minis chart built just in time apparently. This really looks bad, as it should coming off the horrific technical top I've been showing (and even shorted) for a few weeks now. The lowest red diagonal (1760ish) is CRITICAL. That is my red line of death.

Have a great weekend.

GL and GB!!

So, what's up (or down) with the market this week? Are we bears just dreaming? Are they enticing the shorts to line up for another slaughter? Are the finally really in trouble? Is this the beginning of the end? Is this just the LEH incident before the last bull run to yet another improbable ATH? So many thoughts.

If you see it, share it.

Minis 4hr - OK, brand spanking new minis chart built just in time apparently. This really looks bad, as it should coming off the horrific technical top I've been showing (and even shorted) for a few weeks now. The lowest red diagonal (1760ish) is CRITICAL. That is my red line of death.

Have a great weekend.

GL and GB!!

Morning Charts 01/24/14 SPX /ES

Risk OFF? Those are some big words right there. I like these following words better, only cause they agree with what I think will have to come one last time - the un-taper.

Let's hope they are finally losing control so we can get this Keynesian BS over with so we can get on with our lives.

I still have not fixed my ToS here at work. I did post several minis charts last night in yesterday's commentary. I'll move some of those below.

SPX 60m - STB trying to remain calm here and not overreact to what could be very obvious (verge of complete system collapse). Everyone freaked out when Syria was initially going down. Keep your head. I've spoken often recently of their need to lower the rising wedge support to create moar room to move forward. My enormous distrust for the system and having intimately seen them move this market for the past five years keeps me in the manipulation mind frame. We have to see certain levels fail before we can start getting all giddy about aggressively shorting this beast. Cash sub 1800 would be a big deal.

SPX Daily - Two open gaps above, the lower BB is gone (after having noted its extreme narrowness and that potential for increased volatility) and the 50 dma is just below at 1813 along with s/r at 1810. The next stop for cash will be the upper black wedge resistance backtest. Pretty clear that this has been the recent floor. If that cracks then it is even more obvious that the lower black rising wedge support will be the next stop. NOW - IF THAT FAILS - that is the same as my red line of death on my minis chart - then it could very easily be game on for the bears. That's prolly in the 1770-60 range.

Minis made their second target this morning at 1808 and look like they are ready to puke up a lung.

More to come below.

Have a good day.

GL and GB!

"while gold is finally spiking as the realization that absolutely nothing has been fixed, that apparently nobody got the taper is priced in memo, and that soon the Fed will have to untaper, begins to spread. Are the central planners finally starting to lose control?"

Let's hope they are finally losing control so we can get this Keynesian BS over with so we can get on with our lives.

I still have not fixed my ToS here at work. I did post several minis charts last night in yesterday's commentary. I'll move some of those below.

SPX 60m - STB trying to remain calm here and not overreact to what could be very obvious (verge of complete system collapse). Everyone freaked out when Syria was initially going down. Keep your head. I've spoken often recently of their need to lower the rising wedge support to create moar room to move forward. My enormous distrust for the system and having intimately seen them move this market for the past five years keeps me in the manipulation mind frame. We have to see certain levels fail before we can start getting all giddy about aggressively shorting this beast. Cash sub 1800 would be a big deal.

SPX Daily - Two open gaps above, the lower BB is gone (after having noted its extreme narrowness and that potential for increased volatility) and the 50 dma is just below at 1813 along with s/r at 1810. The next stop for cash will be the upper black wedge resistance backtest. Pretty clear that this has been the recent floor. If that cracks then it is even more obvious that the lower black rising wedge support will be the next stop. NOW - IF THAT FAILS - that is the same as my red line of death on my minis chart - then it could very easily be game on for the bears. That's prolly in the 1770-60 range.

Minis made their second target this morning at 1808 and look like they are ready to puke up a lung.

More to come below.

Have a good day.

GL and GB!

Thursday, January 23, 2014

Morning Charts 01/23/14 SPX /ES

OK, I really want to scream and break things. I've just about had it up to here with the lies, especially surrounding the employment figures. The general lies including anything from the BLS or military, spying, drones, wars, terrorists, false flags and all - are bad enough, but when it comes to faking the recovery numbers and living the lie it has to stop.

I know we're ignorant, uneducated, entitled, oblivious and overly trusting of our government to do the right things, but the lies really have to stop. Well, then again, of course they can't stop. Like a compulsive liar they can't stop though as they are so deep in the string of untruths they don't even know what's real and what isn't any more.

Check this from Zero Hedge on the jobs report this morning -

This is outright fraud.

I am just floored, completely speechless, at how worthless, spineless, and utterly bought and paid off our representation is. This nation is in a free fall, and they are offering free drinks, peanuts and inflight movies to keep your attention inside the plane, cause if you bothered to look out the window you might just freak out.

On to the lie -

Daily SPX - SSDD - nothing new to see here. Earnings beats (not revenue of course) keep rolling in. Ever wonder how they always nail it to the one cent beat? Amazing isn't it? Let's not go there.

What can I say about the charts? Well, if the above is any indication they don't matter much at this point. What's real? What can stop them? If that's the case then I reiterate my concerns over what's actually real about any investment you have in this market. Think about that.

I'll reiterate my "event" call. Total control, they either decide to end it or they lose control via some exogenous or external event. I still contend TA will get it right as price will never lie. In the end price will get it right. At this time price (and everything else other than the employment farce) is screaming top or correction. If they overthrow again, they go vertical. Be my guest. I believe if they want to go higher they have to pull back and build a new base.

I'm still in my miniscule short from a week ago Wednesday. I'm still looking down at this point at least near term. I don't think they can let the 1775 level go, so if it falls that will be all I'm willing to give at this point. The charts are a disaster. What isn't a disaster?

More to come below. My work ToS is still down.

Have a good day.

GL and GB!

I know we're ignorant, uneducated, entitled, oblivious and overly trusting of our government to do the right things, but the lies really have to stop. Well, then again, of course they can't stop. Like a compulsive liar they can't stop though as they are so deep in the string of untruths they don't even know what's real and what isn't any more.

Check this from Zero Hedge on the jobs report this morning -

This is outright fraud.

"but the major news is the drop in Emergency Unemployment Compensation beneficiaries from 1.37 million to (drum roll please) zero! Congress decision not to extend this benefit means there are 2 million fewer people on benefits than a year ago. The 1.4 million drop also means the number of people NOT in the labor force is about to rise by the same amount, which as we explained before, means the US unemployment rate is about to drop by up to 0.8%, which means the January unemployment rate could be as low as 5.9%."I'm so ticked off right now I can't even formulate a good rant. Just chalk up another false victory for team manipulation. Their "recovery" is nothing more than data manipulation, and they are proud as hell of themselves for this. You do the math - Emergency unemployment compensation goes to ZERO at the same time continuing claims rose the highest in six months. Shall we mention the 50,000,000 (that's 50 million and rising) people on food stamps? Let's not go there.

I am just floored, completely speechless, at how worthless, spineless, and utterly bought and paid off our representation is. This nation is in a free fall, and they are offering free drinks, peanuts and inflight movies to keep your attention inside the plane, cause if you bothered to look out the window you might just freak out.

On to the lie -

Daily SPX - SSDD - nothing new to see here. Earnings beats (not revenue of course) keep rolling in. Ever wonder how they always nail it to the one cent beat? Amazing isn't it? Let's not go there.

What can I say about the charts? Well, if the above is any indication they don't matter much at this point. What's real? What can stop them? If that's the case then I reiterate my concerns over what's actually real about any investment you have in this market. Think about that.

I'll reiterate my "event" call. Total control, they either decide to end it or they lose control via some exogenous or external event. I still contend TA will get it right as price will never lie. In the end price will get it right. At this time price (and everything else other than the employment farce) is screaming top or correction. If they overthrow again, they go vertical. Be my guest. I believe if they want to go higher they have to pull back and build a new base.

I'm still in my miniscule short from a week ago Wednesday. I'm still looking down at this point at least near term. I don't think they can let the 1775 level go, so if it falls that will be all I'm willing to give at this point. The charts are a disaster. What isn't a disaster?

More to come below. My work ToS is still down.

Have a good day.

GL and GB!

Wednesday, January 22, 2014

Morning Charts 01/22/14 SPX /ES

Earnings season is in full swing. I guess the only mystery left is how many new accounting gimmicks we'll uncover this season. The non-gaap and gaap variations are amazing. They need to change the G in GAAP to an A - from Generally to Any. I guess anything is good as long as they print a number Wall St. likes and the MSM can run with, real or not.

You don't have to peel back the onion too far to deal with another level of the farce. This one is the most blatant and in your face lie there is. Pure and simple accounting fraud/manipulation to manufacture a number that is pleasing no matter the reality. Whatever it takes I guess? They will pay for it one day. When that day comes no one knows, but you can't keep living a lie and pretending all is well via data and financial manipulation forever.

We need to pay close attention to the bond markets in the coming weeks. Chatter and posts are everywhere that reality may start showing up in some rising yields and declining prices. The China Trust issue, Japan, our UST, all may be about to hit a severe bump in the road.I think the bond markets are about to make a statement none of us will be able to ignore (except for the equity markets of course).

On to the lie -

My ToS is still interrupted I think by my security software on the office computer, so no minis again today, but I did grab this from home last night -

Minis 4hr - Rising pink wedge inside the rising green wedge. If they can't drive price above 1847 then price will crack pink support. As soon as that happens though there is red and green support with the 1823 s/r area, so they have a built in circuit breaker if they fail here. Anything sub 1823 and the game could be changing for real.

Daily SPX - It's just nasty overbought and begging for a larger correction. Just needs a catalyst, a small push as most are lined up at the exit doors waiting for them to open.

More to come below. I'll work again today on getting my ToS back up and running.

Have a good day.

GL and GB!

You don't have to peel back the onion too far to deal with another level of the farce. This one is the most blatant and in your face lie there is. Pure and simple accounting fraud/manipulation to manufacture a number that is pleasing no matter the reality. Whatever it takes I guess? They will pay for it one day. When that day comes no one knows, but you can't keep living a lie and pretending all is well via data and financial manipulation forever.

We need to pay close attention to the bond markets in the coming weeks. Chatter and posts are everywhere that reality may start showing up in some rising yields and declining prices. The China Trust issue, Japan, our UST, all may be about to hit a severe bump in the road.I think the bond markets are about to make a statement none of us will be able to ignore (except for the equity markets of course).

On to the lie -

My ToS is still interrupted I think by my security software on the office computer, so no minis again today, but I did grab this from home last night -

Minis 4hr - Rising pink wedge inside the rising green wedge. If they can't drive price above 1847 then price will crack pink support. As soon as that happens though there is red and green support with the 1823 s/r area, so they have a built in circuit breaker if they fail here. Anything sub 1823 and the game could be changing for real.

Daily SPX - It's just nasty overbought and begging for a larger correction. Just needs a catalyst, a small push as most are lined up at the exit doors waiting for them to open.

More to come below. I'll work again today on getting my ToS back up and running.

Have a good day.

GL and GB!

Tuesday, January 21, 2014

Morning Charts 01/21/14 SPX /ES

You know, I try very hard to retain a level head and not freak out. I used to go absolutely ballistic in my rants and raves, but today I try to remain as calm as possible while attempting to convey the severity of the overall situation. This task is becoming increasingly difficult as we near the end of the false recovery road.

STB's mantras have been steady, follow the Fed, follow taper on/off, exit dollar denominated assets, buy physical and prep like hell. The gains on your statement look awesome, but all they are is paper gains. Every try to get those funds into your hands?

The definition of a Demand Accounts has changed drastically since 2008. It used to mean you could demand your cash and get it. Now it means they demand to keep your assets. Your assets in their hands is all that keeps their system alive. It generates fees and leverage. Want to kill the beast? Want to end the Fed? Want to secure your retirement and make sure your savings are safe? There is only one place to do all that and it is not with your funds in their institutions.

I feel the need to start getting a bit more direct with my warnings of doom and gloom again. The False Flags are coming. Their game is coming to an end. Your financial enslavement is complete, now they need you to submit to the system. They need a very large distraction and they need one very soon. All I can say is I hope you are prepared at home. More to come on this later.

On to the lie -

Earnings season - do me a favor and turn off CNBS and just watch the news and the charts. They are such a distraction. Take the hype out of the equation and you will see things much more clearly.

SPX Daily - I honestly think all we have to do is let this rising red wedge play out and that's it. This chart is a technical disaster zone for bully. The lower black wedge support is the line of death.

More to come below. ToS is not loading this morning, so when it finally comes up I'll get you the minis info below.

Have a good week.

GL and GB!

STB's mantras have been steady, follow the Fed, follow taper on/off, exit dollar denominated assets, buy physical and prep like hell. The gains on your statement look awesome, but all they are is paper gains. Every try to get those funds into your hands?

The definition of a Demand Accounts has changed drastically since 2008. It used to mean you could demand your cash and get it. Now it means they demand to keep your assets. Your assets in their hands is all that keeps their system alive. It generates fees and leverage. Want to kill the beast? Want to end the Fed? Want to secure your retirement and make sure your savings are safe? There is only one place to do all that and it is not with your funds in their institutions.

I feel the need to start getting a bit more direct with my warnings of doom and gloom again. The False Flags are coming. Their game is coming to an end. Your financial enslavement is complete, now they need you to submit to the system. They need a very large distraction and they need one very soon. All I can say is I hope you are prepared at home. More to come on this later.

On to the lie -

Earnings season - do me a favor and turn off CNBS and just watch the news and the charts. They are such a distraction. Take the hype out of the equation and you will see things much more clearly.

SPX Daily - I honestly think all we have to do is let this rising red wedge play out and that's it. This chart is a technical disaster zone for bully. The lower black wedge support is the line of death.

More to come below. ToS is not loading this morning, so when it finally comes up I'll get you the minis info below.

Have a good week.

GL and GB!

Monday, January 20, 2014

Morning charts 1/20/14 SPX /ES

That light at the end of the tunnel? Uh, yeah, uh, not good. Not what you want it ti be. Best get out of the way cause that's the reality train barreling down, not some sign that the end is near.

SPX Daily Short - Closer look at the nastiness of the daily chart (including the ominous narrowing BB)

Yes, and by my count this is the 17th neg div without major correction and a whole slew of reversal candles that have been ignored.

Notice the lower black wedge being overthrown by the red wedge - This is nuts.This by all and every right, should be the final push/ wedge. They can not take it any higher here without creating some space or simply going vertical.

Have a good MLK day.

Enjoy the holiday.

GL and GB!

Friday, January 17, 2014

Open Weekend Post 01/18/20/14

You know the drill, share the love and the knowledge.

If you see it - share it.

OK, Friday's last hour - I enjoyed all of these. Yes, all of them. No, I was not, but maybe this weekend ......

Have a great weekend and enjoy the holiday.

GL and GB!

OH! The chart - almost forgot -

Minis 30m - Like I said Friday - I may have had some really dumb luck and nailed a top if not the top Wednesday near the close when I took a miniscule (as in completely irrelevant) short and made my first swing trade in almost two years (nope, not kidding). I still got it - uh huh. Like ... yeah! I'm swinging like a .....The trade was made on principle and for no other reason other than the market should have technically topped at that point.

I don't call it but I trade it - OH THE IRONY!

So, what's potentially happening (other than what we know is happening - the Fed manipulates everything!)? It looks like ...... All support gave way and all hell could break loose and here's why - Pink rising wedge - the final wedge in the multitude of overthrows (cause if it went up again it would have had to go completely vertical) busted (three times) and the second iteration was backtested. The yellow channel resistance was also in the way as well as my obscure gray diagonal that for some strange reason keeps coming back into the picture (maybe if I delete it we won't have this problem anymore?) Well, while all that backtesting and resistance crap was going on, beige channel support came in and offered the market a lift/floor for a few days. Woopsie - that failed as well and now there is no where to go but DOWN! Whammo - there you have it.

Cya!

If you see it - share it.

OK, Friday's last hour - I enjoyed all of these. Yes, all of them. No, I was not, but maybe this weekend ......

Have a great weekend and enjoy the holiday.

GL and GB!

OH! The chart - almost forgot -

Minis 30m - Like I said Friday - I may have had some really dumb luck and nailed a top if not the top Wednesday near the close when I took a miniscule (as in completely irrelevant) short and made my first swing trade in almost two years (nope, not kidding). I still got it - uh huh. Like ... yeah! I'm swinging like a .....The trade was made on principle and for no other reason other than the market should have technically topped at that point.

I don't call it but I trade it - OH THE IRONY!

So, what's potentially happening (other than what we know is happening - the Fed manipulates everything!)? It looks like ...... All support gave way and all hell could break loose and here's why - Pink rising wedge - the final wedge in the multitude of overthrows (cause if it went up again it would have had to go completely vertical) busted (three times) and the second iteration was backtested. The yellow channel resistance was also in the way as well as my obscure gray diagonal that for some strange reason keeps coming back into the picture (maybe if I delete it we won't have this problem anymore?) Well, while all that backtesting and resistance crap was going on, beige channel support came in and offered the market a lift/floor for a few days. Woopsie - that failed as well and now there is no where to go but DOWN! Whammo - there you have it.

Cya!

Morning Charts 01/17/14 SPX /ES

Bank holiday? LOL, just kidding. We used to bark about those with every three day weekend. Not so much anymore even though the threats now far outweigh those just a year or four ago. One will eventually happen. It is inevitable. It is in their game plan of total confiscation and domination, just not quite yet.

Another glorious modern day aspect of holidays that we've been conditioned to expect are terrorist (read: False Flag) events. Fear the bogeyman! He is everywhere! Well, the bogeyman may not be real, but your government, the DHS and the NSA sure as hell are, and they sure as hell are everywhere.

STB really needs to go deep on discussing the coming domestic major false flag events (or one really large possible nuclear event - see South Carolina, military purge and mass Iodine orders). I keep threatening to do this, but like Obummer promised transparency (and every thing else), I have not yet delivered either. At least there is a chance I will keep my promise.

They must have cover, as their plans are progressing and their citizens are becoming unruly. They have so much at stake and are not willing to throw it all away cause of something they call a Constitution. They need a quick and easy way around pesky laws. They need something that will allow them to take the Patriot Act and juice it more than A-Rod could dream of.

This IS coming. It will be to protect their power base and the petro dollar. It will be to cause a world war to cover up the extreme debt and allow us to default on every global obligation. IT will be to bury the CDS market which is the cancer of the central banks. It will be to allow them to grab (steal) the ultimate prize - the $19 trillion in US retirement savings. It will be to allow them to grab the guns and complete the implementation of the police state. As for the NWO and Agenda 21 - more on those disasters in another post.

Bottom line, the end all, be all, domestic false flag is coming. It will put 9/11 to shame. Just hope it is not near you and be prepared for marshal law after it hits.

On to the lie -

Well, since the economy is kicking so much ass (see retail, real estate, employment and moar) is it any wonder the market continues to defy gravity and hover at ATH's? LOL, enough of that crap.

Minis 60m - What I see here is what had become a formless lump of crap that has developed into a very efficient technical system has now gone to crap again. Price had (and still could) followed a system of well defined patterns, but the recent lightning fast recovery and park has left all that (for now) in the past. It's like they reset the machine and want to define their own new set of parameters, thus not allowing the markets and algos to feast on what had become very predictable features.

I'm still working off the premise that the pink rising wedge failed (for a third time) and the markets are backtesting busted support at a potential double top in extremely overbought conditions where the bears have proven their willingness to be more than involved. This is a nightmare scenario heading into a long weekend. It will remain a nightmare scenario, as I have never seen a more perfect technical situation for failure.

You've seen all the nasty charts. I've been trowing them at you since the beginning of the year. They are all in my chartbook if you want to see them. I'll go into more detail on the minis and cash below if necessary. For now, the standard preholiday pump is in play. Lord knows they don't want us sitting around bitching and moaning about some sort of market crash over a holiday weekend.

More to come below.

Have a good weekend.

GL and GB!

Another glorious modern day aspect of holidays that we've been conditioned to expect are terrorist (read: False Flag) events. Fear the bogeyman! He is everywhere! Well, the bogeyman may not be real, but your government, the DHS and the NSA sure as hell are, and they sure as hell are everywhere.

STB really needs to go deep on discussing the coming domestic major false flag events (or one really large possible nuclear event - see South Carolina, military purge and mass Iodine orders). I keep threatening to do this, but like Obummer promised transparency (and every thing else), I have not yet delivered either. At least there is a chance I will keep my promise.

They must have cover, as their plans are progressing and their citizens are becoming unruly. They have so much at stake and are not willing to throw it all away cause of something they call a Constitution. They need a quick and easy way around pesky laws. They need something that will allow them to take the Patriot Act and juice it more than A-Rod could dream of.

This IS coming. It will be to protect their power base and the petro dollar. It will be to cause a world war to cover up the extreme debt and allow us to default on every global obligation. IT will be to bury the CDS market which is the cancer of the central banks. It will be to allow them to grab (steal) the ultimate prize - the $19 trillion in US retirement savings. It will be to allow them to grab the guns and complete the implementation of the police state. As for the NWO and Agenda 21 - more on those disasters in another post.

Bottom line, the end all, be all, domestic false flag is coming. It will put 9/11 to shame. Just hope it is not near you and be prepared for marshal law after it hits.

On to the lie -

Well, since the economy is kicking so much ass (see retail, real estate, employment and moar) is it any wonder the market continues to defy gravity and hover at ATH's? LOL, enough of that crap.

Minis 60m - What I see here is what had become a formless lump of crap that has developed into a very efficient technical system has now gone to crap again. Price had (and still could) followed a system of well defined patterns, but the recent lightning fast recovery and park has left all that (for now) in the past. It's like they reset the machine and want to define their own new set of parameters, thus not allowing the markets and algos to feast on what had become very predictable features.

I'm still working off the premise that the pink rising wedge failed (for a third time) and the markets are backtesting busted support at a potential double top in extremely overbought conditions where the bears have proven their willingness to be more than involved. This is a nightmare scenario heading into a long weekend. It will remain a nightmare scenario, as I have never seen a more perfect technical situation for failure.

You've seen all the nasty charts. I've been trowing them at you since the beginning of the year. They are all in my chartbook if you want to see them. I'll go into more detail on the minis and cash below if necessary. For now, the standard preholiday pump is in play. Lord knows they don't want us sitting around bitching and moaning about some sort of market crash over a holiday weekend.

More to come below.

Have a good weekend.

GL and GB!

Thursday, January 16, 2014

Morning Charts 1/16/14 SPX /ES

I have no clue other than this charts looks absolutely disastrous.

I mentioned yesterday that if they were to overthrow the technical divergences AGAIN, it would have to lead to a vertical move in price. That is all they have left. I really think they need a move to the 1775 level to garner some operating room. They can't take it straight up, can they?

Minis are lost again after the last two days rampage. Form is gone for the most part and price is wandering in a land of diagonals not really indicating anything.

Minis 60m - I'm not about to explain what's going on here. I'll spare you the pain. Best if I just call it below as it happens. Best guess is that she's double topping and backtesting a couple of things at the same time while meeting resistance (all that and the neg divs on the chart above = not good). Problem is the Fed knows and sees this as well. This is like one of those improbable points it can't move up thru but somehow seems to manage the maneuver just fine.

More to come below.

Have a good day.

GL and GB!

I mentioned yesterday that if they were to overthrow the technical divergences AGAIN, it would have to lead to a vertical move in price. That is all they have left. I really think they need a move to the 1775 level to garner some operating room. They can't take it straight up, can they?

Minis are lost again after the last two days rampage. Form is gone for the most part and price is wandering in a land of diagonals not really indicating anything.

Minis 60m - I'm not about to explain what's going on here. I'll spare you the pain. Best if I just call it below as it happens. Best guess is that she's double topping and backtesting a couple of things at the same time while meeting resistance (all that and the neg divs on the chart above = not good). Problem is the Fed knows and sees this as well. This is like one of those improbable points it can't move up thru but somehow seems to manage the maneuver just fine.

More to come below.

Have a good day.

GL and GB!

Wednesday, January 15, 2014

Morning Charts 01/15/14 SPX /ES

So earnings season rolls along with another shady beat and all the glory that goes with it. This morning it was BAC's turn to twist accounting reality. I'll spare you the details, but as usual loan loss reserves were a key player in the beat. The one item that may raise some eyebrows (especially here in budget week for the cash strapped government) was their avoidance of taxes. I guess when it's all funny money on a spreadsheet what does it really matter what you pay in taxes?

On to the lie -

There is really not much left to discuss about the farce they still call a market. At this time all you can do is wait on the inevitable, which to some appears to be coming sooner than later. The whole trading universe is finally on one side of the boat. Finally someone looked up, noticed and said something. This led to others noticing which has now led to the brilliant financial minds of the day warning of corrections to come.

We bears should have a near term problem with that. When bully starts treading on your bear turf, that is usually not a good sign. When even the bulls are calling for a top or correction, there comes cognitive dissonance. Not good. You stay on your side of the field and I'll stay on mine. That's the way the game is supposed to be played and when you come over here things get screwed up, so please get back in your box and stay there.

This sort of leads me back to my "Event". I don't know how many times I'm gonna have to say it, but it's going to take an external (exogenous) "event" that is out of "their" control for this thing to have a meaningful turn. I believe that something has happened that we do not know about which has caused them to either lose a degree of control or that for them was a game ending move. It is possible they are simply hanging on right now.

I've shown the charts. They were ridiculous two years ago and are twenty times worse now. All there is to do now is sit and wait. How you choose to do that is your choice. I think prepping and moving out of the dollar into real assets is the way to go. The longer you stay in this farce of fiat the harder and more expensive it will be to convert (if you even get the chance).

Minis 30m - I'm watching the yellow falling channel here and the backtest of the beige and pink diagonals. Kind of a STB point right above. I'm interested to see what may happen there. I remain bearish for many reasons, but that does not mean they can't remain in stomp the bears mode either.

SPX Daily - Black rising wedge. When they lose this support, it should be all over.

More to come below.

Have a good day.

GL and GB!

On to the lie -

There is really not much left to discuss about the farce they still call a market. At this time all you can do is wait on the inevitable, which to some appears to be coming sooner than later. The whole trading universe is finally on one side of the boat. Finally someone looked up, noticed and said something. This led to others noticing which has now led to the brilliant financial minds of the day warning of corrections to come.

We bears should have a near term problem with that. When bully starts treading on your bear turf, that is usually not a good sign. When even the bulls are calling for a top or correction, there comes cognitive dissonance. Not good. You stay on your side of the field and I'll stay on mine. That's the way the game is supposed to be played and when you come over here things get screwed up, so please get back in your box and stay there.

This sort of leads me back to my "Event". I don't know how many times I'm gonna have to say it, but it's going to take an external (exogenous) "event" that is out of "their" control for this thing to have a meaningful turn. I believe that something has happened that we do not know about which has caused them to either lose a degree of control or that for them was a game ending move. It is possible they are simply hanging on right now.

I've shown the charts. They were ridiculous two years ago and are twenty times worse now. All there is to do now is sit and wait. How you choose to do that is your choice. I think prepping and moving out of the dollar into real assets is the way to go. The longer you stay in this farce of fiat the harder and more expensive it will be to convert (if you even get the chance).

Minis 30m - I'm watching the yellow falling channel here and the backtest of the beige and pink diagonals. Kind of a STB point right above. I'm interested to see what may happen there. I remain bearish for many reasons, but that does not mean they can't remain in stomp the bears mode either.

SPX Daily - Black rising wedge. When they lose this support, it should be all over.

More to come below.

Have a good day.

GL and GB!

Tuesday, January 14, 2014

Morning Charts 01/14/14 SPX /ES

I'll spare you the usual earnings rant this quarter. You have heard it before. The short version - lower the hurdle for the easy beat and get no punishment cause QE lifts all ships no matter how many holes they have in them.

This brings us to JPM, "Oh, and yes: for the purists, here is the bottom line: of that $5.3 billion in "earnings", $1.3 billion or double the expected (at least from Barclays) $616MM, came from loan loss reserve releases. Accounting magic wins again." Ahhh, accounting magic. One of the pillars of deregulation and the new normal.

Earnings now is more an exercise than an event. It has gone from a most anticipated frontrunner event to a ho hum yawner where (because of accounting miracles) we all know exactly what's going to happen before they announce. There is no more suspense. They try to create it and act like there is some real drama, but in reality, when you can plug any numbers you want into the spreadsheet, its become another lipstick on pig event and nothing more.

The MSM still needs something to crow about, and the money managers (term used loosely) needs something to tout as the next big winner. The Cramers need something to entertain the mass of ignorance that once was a wise and knowledgeable nation. Crank up the hype machine. It's earnings season.

BARF! As stated here literally for years, do nothing more than follow the Fed and you will win. QE ON = Markets UP. It is that easy. More recently STB's narrowed that formula to listen to nothing more than taper talk. That's the only thing that moves the market. See yesterday for the most recent example of that.

On to the lie -

OK, we finally got a retracement greater than 23%, but that was off of a nothing blow off top move from the 1753 low. Want to impress me and make a more meaningful move? Try a retracement off the November '12 lows where all this BS really started. A simple/normal 38% retracement of that move would take us to 1642. Yes, that's a simple/normal move to 1642, but sounds like the end of the worls doesn't it. HA! That's still 56 points ABOVE the '07 top. LOL, this thing is so overbought.

I have been harping for the past few weeks about the bearish movement and the overbought conditions. All it took was a little taper talk yesterday and a four alarm fire went off. This market is VERY nervous. Everyone knows it should be topping and is in dire need of a massive correction. The problem is that with the underlying everything any correction is going to become a crash. Everyone has one finger on the eject button, everyone.

Minis 60m - All NT and recent support gave way yesterday. Yesterday was, a big deal. It was the first big crack in the dam. Don't panic, but be alarmed. We have to walk these things down one support at a time. Right now the red diagonal of death at 1750 seems like the obvious point they may let it go to, but we have about three other supports to get thru first. I added the yellow falling channel yesterday. I lowered pink support yesterday and even that got blown thru. Beige channel is gone. Upper red rising wedge resistance has been taken back. Green and blue are next hurdles.

Minis 4hr - Here is larger look. The pink rising wedge to potentially end the green rising wedge failed yesterday. Uppe red resistance was taken back. Green rising wedge support is next then the blue long term (like off the '08 lows) resistance is next. Then the red diagonal of death lies with the green rising wedge target line. Not till the 1750 area goes will it be game on for the bears.

You remain calm while they remain desperate. They are at their most dangerous and illogical at this point. Let them make the mistakes and you capitalize. Follow their lead.

More to come below.

Have a good day.

GL and GB!

This brings us to JPM, "Oh, and yes: for the purists, here is the bottom line: of that $5.3 billion in "earnings", $1.3 billion or double the expected (at least from Barclays) $616MM, came from loan loss reserve releases. Accounting magic wins again." Ahhh, accounting magic. One of the pillars of deregulation and the new normal.

Earnings now is more an exercise than an event. It has gone from a most anticipated frontrunner event to a ho hum yawner where (because of accounting miracles) we all know exactly what's going to happen before they announce. There is no more suspense. They try to create it and act like there is some real drama, but in reality, when you can plug any numbers you want into the spreadsheet, its become another lipstick on pig event and nothing more.

The MSM still needs something to crow about, and the money managers (term used loosely) needs something to tout as the next big winner. The Cramers need something to entertain the mass of ignorance that once was a wise and knowledgeable nation. Crank up the hype machine. It's earnings season.

BARF! As stated here literally for years, do nothing more than follow the Fed and you will win. QE ON = Markets UP. It is that easy. More recently STB's narrowed that formula to listen to nothing more than taper talk. That's the only thing that moves the market. See yesterday for the most recent example of that.

On to the lie -

OK, we finally got a retracement greater than 23%, but that was off of a nothing blow off top move from the 1753 low. Want to impress me and make a more meaningful move? Try a retracement off the November '12 lows where all this BS really started. A simple/normal 38% retracement of that move would take us to 1642. Yes, that's a simple/normal move to 1642, but sounds like the end of the worls doesn't it. HA! That's still 56 points ABOVE the '07 top. LOL, this thing is so overbought.

I have been harping for the past few weeks about the bearish movement and the overbought conditions. All it took was a little taper talk yesterday and a four alarm fire went off. This market is VERY nervous. Everyone knows it should be topping and is in dire need of a massive correction. The problem is that with the underlying everything any correction is going to become a crash. Everyone has one finger on the eject button, everyone.

Minis 60m - All NT and recent support gave way yesterday. Yesterday was, a big deal. It was the first big crack in the dam. Don't panic, but be alarmed. We have to walk these things down one support at a time. Right now the red diagonal of death at 1750 seems like the obvious point they may let it go to, but we have about three other supports to get thru first. I added the yellow falling channel yesterday. I lowered pink support yesterday and even that got blown thru. Beige channel is gone. Upper red rising wedge resistance has been taken back. Green and blue are next hurdles.

Minis 4hr - Here is larger look. The pink rising wedge to potentially end the green rising wedge failed yesterday. Uppe red resistance was taken back. Green rising wedge support is next then the blue long term (like off the '08 lows) resistance is next. Then the red diagonal of death lies with the green rising wedge target line. Not till the 1750 area goes will it be game on for the bears.

You remain calm while they remain desperate. They are at their most dangerous and illogical at this point. Let them make the mistakes and you capitalize. Follow their lead.

More to come below.

Have a good day.

GL and GB!

Monday, January 13, 2014

Monday Chartapalooza 1/12/14 SPX /ES

Time to panic? I don't know but by the looks of things something has to happen sooner than later. There are so many balls in the air that something has to come crashing down sooner or later. China, Iran, MENA, Japan (and Fuku), EU lying in the weeds, our own plethora of issues, something will pop sooner than later and the market is telling us this.

First we have a monthly bunch issue -

Then we have a slightly one sided market -

The RUT is the best textbook example of a technical top there is.

And the SMA's say ...

And Bullish Percent SPX sez - (This is the most ridiculous of all the charts IMO)

Monthly index comparison - Shows 'em all at extremes.

That is just a sampling of a bevy of charts I could have thrown at you this morning. The CPC and BP charts are the most telling of an impending correction due strictly to severely overbought conditions. Tomorrow I'll get into the currencies, commodities and other stuff that will only reinforce the charts above.

Minis 4hr - Your first sign a big change may be happening is the breakdown of pink rising wedge support. This could be the final reset of the lower support diagonal before one last push up, but given all the factors above it could also be the beginning of some sort of meaningful correction. Key support goes red 1824, green and blue near 1800, pink at 1775 and the red line of death at 1750.

Minis 60m - is a complete mess, but it has form. The volatility we discussed last week has not gone away. The bears are in play and continue to bother bully. The beige rising wedge support at 1829 is your key today. If that goes then red rising wedge resistance backtest is the next stop near 1820. If that cracks, it opens Pandora's box and the road to 1750.

Can the market just fall or correct on its own? I don't think so, so it is time to start watching for events. Catalysts that will rock the boat. Things that are out of their control may be about to start popping up. Things that are in their control (like false flags) may start popping up as well. Of course the market does little without taper or QE talk and those rumors may pick up as well. The bear's greatest fear - taper off and moar QE on.

You still have to follow their lead. With GS calling for a potential 10% pullback (which is impossible cause the red line of death is just short of 5%), and big corps actually selling into the rally now one has to be really careful and not put the cart ahead of the horse. Technically we look better than ever for a correction, but the market is still under their total control and they love squashing shorty.

Am I gonna call a top? Very possible. Considering it here.

More to come below.

Have a good week.

GL and GB!

First we have a monthly bunch issue -

Then we have a slightly one sided market -

The RUT is the best textbook example of a technical top there is.

And the SMA's say ...

And Bullish Percent SPX sez - (This is the most ridiculous of all the charts IMO)

Monthly index comparison - Shows 'em all at extremes.

That is just a sampling of a bevy of charts I could have thrown at you this morning. The CPC and BP charts are the most telling of an impending correction due strictly to severely overbought conditions. Tomorrow I'll get into the currencies, commodities and other stuff that will only reinforce the charts above.

Minis 4hr - Your first sign a big change may be happening is the breakdown of pink rising wedge support. This could be the final reset of the lower support diagonal before one last push up, but given all the factors above it could also be the beginning of some sort of meaningful correction. Key support goes red 1824, green and blue near 1800, pink at 1775 and the red line of death at 1750.

Minis 60m - is a complete mess, but it has form. The volatility we discussed last week has not gone away. The bears are in play and continue to bother bully. The beige rising wedge support at 1829 is your key today. If that goes then red rising wedge resistance backtest is the next stop near 1820. If that cracks, it opens Pandora's box and the road to 1750.

Can the market just fall or correct on its own? I don't think so, so it is time to start watching for events. Catalysts that will rock the boat. Things that are out of their control may be about to start popping up. Things that are in their control (like false flags) may start popping up as well. Of course the market does little without taper or QE talk and those rumors may pick up as well. The bear's greatest fear - taper off and moar QE on.

You still have to follow their lead. With GS calling for a potential 10% pullback (which is impossible cause the red line of death is just short of 5%), and big corps actually selling into the rally now one has to be really careful and not put the cart ahead of the horse. Technically we look better than ever for a correction, but the market is still under their total control and they love squashing shorty.

Am I gonna call a top? Very possible. Considering it here.

More to come below.

Have a good week.

GL and GB!

Friday, January 10, 2014

Open Weekend Post 01/11-12/14 SPX /ES

You know the drill, share the love and the knowledge.

I'll be updating some charts thanks to RC digging into the chartbook deeper than anyone is really supposed to. I'll be doing some spring cleaning in there as well so some things may go missing. If I delete something you use let me know and I'll recreate it.

If you see it post it.

Have a good weekend.

GL and GB!

I'll be updating some charts thanks to RC digging into the chartbook deeper than anyone is really supposed to. I'll be doing some spring cleaning in there as well so some things may go missing. If I delete something you use let me know and I'll recreate it.

If you see it post it.

Have a good weekend.

GL and GB!

Morning Charts 01/10/14 SPX /ES