I am so close to a full blown rant post filled with countless 4 letter words. You need one, I need one and the antagonists deserve one. This crud is so out of hand. You know it. I know it. "They" know it. Hell, we all know it and sit aimlessly on our hands as if nothing can or should be done.

Like trying to give a sick child medicine, they resist and resist. Well little Christopher, you won't get any better till you take your medicine. But it tastes bad daddy. Well son, if you don't take it you won't get better. Sadly our nation is a lot like little Christopher. Taking the medicine and dumping it into the plant down the hall and claiming he took it. Dad can't figure out why Christopher is not getting any better and why the plants keep dying. Does this story sound familiar? Well our "child" is not getting any better and plants are dying all over the place. By the time we do get around to taking our medicine (cause we'll have been admitted to the ER in a comatose state) it may be to late.

Fantasy land does exist. You are living in it. The fantasy is that things are getting better. That the worst has come and gone. That this employment report will make all things better. That the BLS is not reporting BS. That the ratings agencies are honest and truthful. That the banks are not really insolvent. That the $27 trillion spent to solve our issues did not go to waste (or to the banksters). That the reflation trade will make everything better. That regulation is not the problem. That corruption does not exist. That government intervention is not the only reason GDP is above zero. That the markets are not manipulated. That monetization does not exist. That the price of gold is not and never has been manipulated. That the new health care bill is a glorious thing. That our "president" has held every promise he made during his campaign. That our president is a legal citizen. Shall I continue, or do you get my drift? Reality has been skewed worse now than any time in history.

How the heck we are all not in the streets raising total hell is beyond me. I assume we have been conditioned to a point (like rats in a maze or a cage). We have become so complacent that to react to anything is waaaay to much trouble. We are an ill informed, worthless (literally), lazy, unmotivated, disconnected, selfish, self centered, arrogant nation. We are collectively the most pathetic group of individuals on the planet. A bunch of spoon fed drones. Our forefathers would truly be ashamed of whet we have become.

They fought for this? I don't think so. They did not fight and die for us to be a bunch of freeloaders. They fought for us to be free. Well folks, your freedom is being taken bit by bit right in front of your eyes and apparently you either don't give a darn or you ... well, don't give a darn. See those cameras on the corners? How about "legal" wire taps or naked body scanners in the airports. Homeland security "in the name of terrorism" has stolen so many of our God given or "constitutional" rights that there may not be any left.

Realistically our "president" has become a Fascist ruler given virtually unlimited powers in the name of the Patriot Act. Do you know some of the items that were in that "health care" bill? Ever heard of Section 203 and the Civil National Security Force or the Ready Reserve force? (h/t M33). Remember him speaking of a "national security force" during his campaign? Not sure what the heck that has to do with HC, but it sure was in there. Anyway, there is his second promise kept (first was health care). This is some scary stuff. I suggest you take a look.

In case you have not heard House Minority leader John Boehner's closing argument against the health care reform bill, here it is - Did anyone know what was in it? Was it transparent as promised. Was it slammed thru without allowing time for review as promised? Or as Pelosi said, we'll just have to pass it to find out what's in it.

Even our elected leaders are as lax as we are. No one gives a damn. If it does not involve money, power or a future job at Goldman Sacks, it does not matter. Other than Alex Jones and a few of the "fringe" or "whacked out" extremists, is anyone doing a damn thing to correct or fight these issues facing our nation? Sadly, no. You will have a chance this November. Let me correct that, you MAY have a chance this November if elections are not suspended by Barry.Time To Take Back The Country; Congressional Candidates Deserving Your Support: Ron Paul, John Dennis, BJ Lawson, Rand Paul

Folks, it is really bad out there. The global financial system is about to implode. It will. It is beyond repair. Hundreds of trillions (or maybe even Quadrillions) of nasty toxic waste has been laid out there by the banksters to prop up the global Ponzi scheme (and to profit handsomely from). Our pension to borrow our way out of budget deficits (or any deficit period) has finally caught up with the world. Would you give any significant sum of money to an irresponsible neighbor whose is out of work, whose home is being foreclosed on and is about to file for bankruptcy? Say hello to Greece and the rest of the PIIGS. They will be the first domino to fall. They can't borrow any more and no one will lend to a lost cause. Can't you see this? (well, you can, but John Q Public has no friggin clue cause of the ever informant and truthful MSM.) Why the hell do you think the banks are hoarding cash and not lending? Because they know the worst is not over. They know the depths of the issues that face this nation financially. They know what they have "off balance sheet" and it ain't pretty. They know the rules have been changed to rig the game and if (or the 'remotely' possible when) the rules change back nothing will ever be the same. So the big grab is on.

I am extremely disappointed in our leaders for letting this happen (starting with the Clinton administration and every elected official since - some may make a case for going back as far as Nixon which I can agree with). What the hell were they thinking? Who were they really serving us or the special interests (that can donate ad nauseum to campaigns now thanks to the fine bunch in office now)? Sadly this whole mess will come to an end, but not thru any significant corrective actions. Our hand will be forced. The patient will be critically ill and puking up a lung before any real corrective measures will be taken.

Please do your part to unseat every official that is in office now (other than Ron Paul and a few select others). Please support move your money, audit the fed, Americans for a Balanced Budget Amendment, Get Involved

and other worthwhile groups that are trying to make a difference.We can win our country back. It will be a painful fight, but a purging is necessary. So lets start on the hill and work our way from there. If we don't, America may not survive as you know it today.

UPDATE: U.S. Standard of Living Unsustainable Without Drastic Action, Former Top Govt. Accountant Says

UPDATE 2: Greece Heads Back To Square One As EU's Bazooka Was Nothing More Than A Water Pistol "Europe's rescue plan for Greece is now bank at square one. The reason the plan failed is there never really was a plan to begin with, just bazooka talk." Hate to say I've been telling you this all along. You would have thought differently from whay world leaders and the MSM have told you. I'm telling you that you can not believe one thing they say.

Wednesday, March 31, 2010

Morning Post, SPX, S&P 500

Jobs, schmobs - the real issue is 24 Hours Until The End Of MBS Purchases By The Fed; Then What? I'd say they are going to shut down the presses for some much needed rest, maintenance and to let the glowing red hot machinery cool down for another run in a month or two. Bye bye QE. Let the games begin.

Economic Calendar - ADP disappoints, PMI, factory orders and petroleum later this morning.

Pivot Points - Know 'em.

Minis dropped 5 on the ADP news and have reached a support line I have at 1163 off of the 3/15 low. If that cracks next stop is 55. The quarter is over. Statements have been printed.

SPX 60m - Same chart as yesterday, but it is the best I got right now. 30m and 60m drifting south with the dailys falling as well. The weeklys had the F Sto whipsaw at the top, but are possibly getting a S Sto bear cross as we speak. For the bears, hopefully these trends can not be reversed and the long overdue sell off continues with even more strength.

Dollar - trending down and set a lower low overnight. It should be at some sort of support here, but if not there is a support line near 80.5.

Oil - Spiking this am. Nearing resistance line just above 84. 86.5 should be the max if it continues to run.

NG- I think it is turning for a pop. (stupid I know, but someone had to be the village idiot every now and then)

Gold - Stuck under a resistance line. It may churn up but that's it.

EUR/USD - At resistance fighting to hold support at the 61.8% fib off of the great rise. We all should expect nothing but continued weakness till the euro exists no longer.

I blogged on Focal Equity last night - Can This Be A Near Term Bottom For UNG?

I spend my days on the board at Juggernaut Trading. Come join the mayhem. If you do sign up for a free look, please make sure you include my name in the reference box.

GL!

Economic Calendar - ADP disappoints, PMI, factory orders and petroleum later this morning.

Pivot Points - Know 'em.

Minis dropped 5 on the ADP news and have reached a support line I have at 1163 off of the 3/15 low. If that cracks next stop is 55. The quarter is over. Statements have been printed.

SPX 60m - Same chart as yesterday, but it is the best I got right now. 30m and 60m drifting south with the dailys falling as well. The weeklys had the F Sto whipsaw at the top, but are possibly getting a S Sto bear cross as we speak. For the bears, hopefully these trends can not be reversed and the long overdue sell off continues with even more strength.

Dollar - trending down and set a lower low overnight. It should be at some sort of support here, but if not there is a support line near 80.5.

Oil - Spiking this am. Nearing resistance line just above 84. 86.5 should be the max if it continues to run.

NG- I think it is turning for a pop. (stupid I know, but someone had to be the village idiot every now and then)

Gold - Stuck under a resistance line. It may churn up but that's it.

EUR/USD - At resistance fighting to hold support at the 61.8% fib off of the great rise. We all should expect nothing but continued weakness till the euro exists no longer.

I blogged on Focal Equity last night - Can This Be A Near Term Bottom For UNG?

I spend my days on the board at Juggernaut Trading. Come join the mayhem. If you do sign up for a free look, please make sure you include my name in the reference box.

GL!

Tuesday, March 30, 2010

Wonders Never Cease

Let it fall and park it in SSO is another winner. Imagine that as the markets again cycle the 30m minis to a bearish divergence early on setting up a nice rally off of support. Today was a little different as the minis did take out and back test a LT support line. ADP tomorrow and passover may have kept a lid on things today.

Ireland may be first in line for the role of austerity king as Ireland Stunned To Uncover "Truly Shocking" Information By Its Banks, Institutes Austerity. Let them be the gunny PIIGS in this fiasco and lay the model for how not/to take the banks under authority. I'm sure Ben will have his ear to the ground and will be taking notes as austerity measures will hit here eventually (well, maybe after Greece, Italy, Spain and then half the EU. "As disclosed, Ireland has instituted a "Bad Bank" concept to acquire 1,200 loans, or €81 billion worth, at a 47% discount. Sounds about right. Of course, the US financial system still carries most of its loans at about par: you see we have a printer and they don't, so we can do whatever we want"

Your Greece default/soap opera article of the day comes from naked capitalism. Auerback: Greece and the EuroZone: Angie, Ain’t it Time to Say Goodbye? This is a good primer for why the Greece situation possibly it happened and why a messy default may be the only answer. How Greece (and the remaining PIIGS get out of their debt laden holes is beyond me. Sacrifices will have to be made. Austerity measures will exist. My question is, if overextended borrowing got you into this mess, then how is picking up another $22bn gonna help? If they can't afford the debt now and if we all know Greece will default eventually, then why not go ahead and face the music?

Since there is not fraud or corruption to worry about we'll most likely not have banking issues like Ireland. Wait, what's that ZH reported - Former SEC Staffer Blasts The Regulator's Short Selling Ban Lunacy, Calls Decision Purely Motivated By Politics. Funny CNBS did not pick that one up to dispense to the masses. "The U.S. Securities and Exchange Commission’s decision to restrict short selling was a political decision rather than one based on evidence, according to a former agency official who says it may set a precedent for future decisions." And what politics was involved pray tell? Why, the type that would make the new president incredibly unpopular even before he was sworn in. It becoming increasingly clear with each passing day that this country's equity market is nothing but a sham and a teleprompter-friendly mirror before which Obama can act glum, even as the very regulators allow the market to be manipulated in a way that encourages risk taking, and thus delay and inevitable and terminal crash." There goes that "crash" word again."Sham" and "regulators allowing the market to be manipulated" are strong statements - not really - only if you work for the MSM.

Rigged markets hugh? Don't Invest In Ridiculously-Rigged (And Thin) Markets from Denninger was inspired by a recent Tavakoli piece about cornering the gold markets, ETF's and supply. Scam? Nah, futures traders and the banks would never conspire to enter ridiculous positions and try to corner the market like the Hunt brothers did. If you own paper gold (ETF), look out. Denninger says if you own physical gold, "I'll stay away from this one - the criminals have proved that they can intentionally falsify the valuation of trillions of dollars in "assets" on balance sheets and otherwise cheat with wild abandon, but nobody will bring charges. There is no reason to believe that you or I will be the ones who are able to get through the tiny little door if indeed this is the game that is being run, and every reason to believe that instead of the starry-eyed profits you dream of you will instead suffer a monstrous loss." Me, I have no opinion cause it is all so screwed up no one will be able to value the physical gold cause no one will ever allow an audit of their tungsten in stock. Read the Tavakoli piece. It is required reading.

How do you value gold by the way? The Case for Position Limits: What is the 'Spot Price' of Gold and Silver And How Is It Set? is the question asked in a post from Jesse's Cafe American. "I had not been able to obtain the actual calculation used by any of the principle quote providers. And I am not saying that they are doing anything wrong at all. Or right for that matter, since I do not audit them or look over their shoulder. I do not know how accurate anyone's reportage might be, or how to explain the discrepancies between the futures prices and the spot prices that occur all too frequently these days. How can one without more transparent knowledge?" I'm telling you the meltdown will lead to massive confusion one day and no one will know how much gold will be worth. No audit = no value and we all know we will never get any sort of truthful audit. Till then the scam rolls on. Here is a video from INO where they forecast that the price of gold will remain range bound for the next year. I tend to want to agree with them at this time.

Mish must be losing it. This post is great. Searching For Jobs - Just How Bad Is It? This one is quite timely with the rosy ADP number coming out tomorrow. You see when there are laid off graphic designers and teachers applying for pooper scooper jobs at kennels there must be issues with hiring and availability of quality work. The union comparison of cat to dog scoopers really underscores the 'crap' that the unions drive and require to drive up all costs associated with their existence.

Washington's blog has this Dodd's Financial "Reform" Bill Is Nothing but a Placebo for a Very Sick Economy. you may have seen this already, but if you have not, our government's (Dodd's) idea of "reform" is another hollow bill that does nothing. "But Senator Dodd is trying to push through a financial "reform" which bill won't do anything to break up the too big to fails, or do much of anything at all. It's got a reassuring name and a nice, sugary taste ... but there's no real medicine in it." The TBTF's must be broken up. It will happen, only after they have decimated the nation and it will be yet another inconsequential act by our government.

That is enough for tonight. More great news hugh? Give it time. The great unraveling will come. it may take years, but it will come.

Ireland may be first in line for the role of austerity king as Ireland Stunned To Uncover "Truly Shocking" Information By Its Banks, Institutes Austerity. Let them be the gunny PIIGS in this fiasco and lay the model for how not/to take the banks under authority. I'm sure Ben will have his ear to the ground and will be taking notes as austerity measures will hit here eventually (well, maybe after Greece, Italy, Spain and then half the EU. "As disclosed, Ireland has instituted a "Bad Bank" concept to acquire 1,200 loans, or €81 billion worth, at a 47% discount. Sounds about right. Of course, the US financial system still carries most of its loans at about par: you see we have a printer and they don't, so we can do whatever we want"

Your Greece default/soap opera article of the day comes from naked capitalism. Auerback: Greece and the EuroZone: Angie, Ain’t it Time to Say Goodbye? This is a good primer for why the Greece situation possibly it happened and why a messy default may be the only answer. How Greece (and the remaining PIIGS get out of their debt laden holes is beyond me. Sacrifices will have to be made. Austerity measures will exist. My question is, if overextended borrowing got you into this mess, then how is picking up another $22bn gonna help? If they can't afford the debt now and if we all know Greece will default eventually, then why not go ahead and face the music?

Since there is not fraud or corruption to worry about we'll most likely not have banking issues like Ireland. Wait, what's that ZH reported - Former SEC Staffer Blasts The Regulator's Short Selling Ban Lunacy, Calls Decision Purely Motivated By Politics. Funny CNBS did not pick that one up to dispense to the masses. "The U.S. Securities and Exchange Commission’s decision to restrict short selling was a political decision rather than one based on evidence, according to a former agency official who says it may set a precedent for future decisions." And what politics was involved pray tell? Why, the type that would make the new president incredibly unpopular even before he was sworn in. It becoming increasingly clear with each passing day that this country's equity market is nothing but a sham and a teleprompter-friendly mirror before which Obama can act glum, even as the very regulators allow the market to be manipulated in a way that encourages risk taking, and thus delay and inevitable and terminal crash." There goes that "crash" word again."Sham" and "regulators allowing the market to be manipulated" are strong statements - not really - only if you work for the MSM.

Rigged markets hugh? Don't Invest In Ridiculously-Rigged (And Thin) Markets from Denninger was inspired by a recent Tavakoli piece about cornering the gold markets, ETF's and supply. Scam? Nah, futures traders and the banks would never conspire to enter ridiculous positions and try to corner the market like the Hunt brothers did. If you own paper gold (ETF), look out. Denninger says if you own physical gold, "I'll stay away from this one - the criminals have proved that they can intentionally falsify the valuation of trillions of dollars in "assets" on balance sheets and otherwise cheat with wild abandon, but nobody will bring charges. There is no reason to believe that you or I will be the ones who are able to get through the tiny little door if indeed this is the game that is being run, and every reason to believe that instead of the starry-eyed profits you dream of you will instead suffer a monstrous loss." Me, I have no opinion cause it is all so screwed up no one will be able to value the physical gold cause no one will ever allow an audit of their tungsten in stock. Read the Tavakoli piece. It is required reading.

How do you value gold by the way? The Case for Position Limits: What is the 'Spot Price' of Gold and Silver And How Is It Set? is the question asked in a post from Jesse's Cafe American. "I had not been able to obtain the actual calculation used by any of the principle quote providers. And I am not saying that they are doing anything wrong at all. Or right for that matter, since I do not audit them or look over their shoulder. I do not know how accurate anyone's reportage might be, or how to explain the discrepancies between the futures prices and the spot prices that occur all too frequently these days. How can one without more transparent knowledge?" I'm telling you the meltdown will lead to massive confusion one day and no one will know how much gold will be worth. No audit = no value and we all know we will never get any sort of truthful audit. Till then the scam rolls on. Here is a video from INO where they forecast that the price of gold will remain range bound for the next year. I tend to want to agree with them at this time.

Mish must be losing it. This post is great. Searching For Jobs - Just How Bad Is It? This one is quite timely with the rosy ADP number coming out tomorrow. You see when there are laid off graphic designers and teachers applying for pooper scooper jobs at kennels there must be issues with hiring and availability of quality work. The union comparison of cat to dog scoopers really underscores the 'crap' that the unions drive and require to drive up all costs associated with their existence.

Washington's blog has this Dodd's Financial "Reform" Bill Is Nothing but a Placebo for a Very Sick Economy. you may have seen this already, but if you have not, our government's (Dodd's) idea of "reform" is another hollow bill that does nothing. "But Senator Dodd is trying to push through a financial "reform" which bill won't do anything to break up the too big to fails, or do much of anything at all. It's got a reassuring name and a nice, sugary taste ... but there's no real medicine in it." The TBTF's must be broken up. It will happen, only after they have decimated the nation and it will be yet another inconsequential act by our government.

That is enough for tonight. More great news hugh? Give it time. The great unraveling will come. it may take years, but it will come.

Morning Post, SPX, S&P 500

Big news week plus the holidays make for an interesting and daring combination. The minis appear to be wedging up as they climb a support line with little resistance above and multiple support points below. Little pop on the Case-Shiller number.

Economic Calendar - Redbook, Case-Shiller and Consumer Confidence today with ADP and a slew of others tomorrow.(Plenty of BS from the BLS this week)

Pivot Points - Know 'em

SPX 60m -The bears get nothing till that lower trendline cracks. When it does I expect a minimum of 1121 to 1128 as a target. This pattern should be ending, but with this market you never know. We know from the pst below a corrective is in order, but we also know the market can remain overbought for extended periods. There is excessive bullish sentiment. The dollar is trending down. The weeklys appear to be trying to roll over. Stay on your toes is all I can say.

Economic Calendar - Redbook, Case-Shiller and Consumer Confidence today with ADP and a slew of others tomorrow.(Plenty of BS from the BLS this week)

Pivot Points - Know 'em

SPX 60m -The bears get nothing till that lower trendline cracks. When it does I expect a minimum of 1121 to 1128 as a target. This pattern should be ending, but with this market you never know. We know from the pst below a corrective is in order, but we also know the market can remain overbought for extended periods. There is excessive bullish sentiment. The dollar is trending down. The weeklys appear to be trying to roll over. Stay on your toes is all I can say.

Monday, March 29, 2010

The Impossible Is Happening Right In Front Of Your Eyes, $SPX, S&P500

This is a daily chart with daily indicators. This is not some weak puny little 60 or 30m chart, but a daily chart. The divergences on this chart are real and not your imagination. The MACD bear cross is real. The MACD hist falling off a cliff is real. The Slow Sto bear cross and plummet is real. The divergences on Williams, Force, PPO and MFI are real. ADX is really falling. Yes, Ultimate is falling. Yes Accum/Dist is in orbit. SPXA50 is at 444. So, you tell me if it is normal that the market was up 6.63 points today, over 1/2 a percent?

The market does defy gravity and any force of nature that could pull it down. With no regulation, rampant corruption, and autobots (more like Decepticons) controlling all the trading in an extremely thin market nothing natural or of any statistical measure really matters any more. Listening to the UBS pit trader run the show today was astounding. Like a hungry lion with an insatiable appetite, nothing was going to get by his marching orders to lift the price at any cost. This is some really screwed up stuff if you are a realist. If you are a standard sheeple without any conscience or inclination to achieve, none of this matters to you.

I have been behind the manipulation theme for over a year now. I get it. It is real, but again my frustration boils over. This is a load of crap. This is, in the name of saving the union, destroying the fabric of our constitution. The raping of America for the glory of the banks has gone to far, and I have really had enough. It is out of control and no one is doing a damn thing to stop it. You can kiss everything you know goodbye, cause when this is over there will be nothing left. Our dignity as a nation is gone. We have been sold out.It will crash one day. There is no recovery. We have done nothing to address the core credit problems that caused this mess. They have simply prolonged the pain and suffering thru a massive waste of money (or transfer of wealth to the banks) in the name of reflation.

We have 8 (EIGHT) months of cash flow left as a nation (yes, this includes the 1.9 trillion they just extended to the treasury ceiling). Do you care to tell me where they will make up the difference when this fairy tale ends? That's right, taxes and real budget cuts and both are gonna really hurt. March 29, 2010 Total Debt Subject To Limit: $12,629,674,000,000

Care to look at the Debt Clock?

This Daily SPX charts is better viewed HERE. Look and revel in the impossible. It is occurring on this chart. View and be amazed.

The market does defy gravity and any force of nature that could pull it down. With no regulation, rampant corruption, and autobots (more like Decepticons) controlling all the trading in an extremely thin market nothing natural or of any statistical measure really matters any more. Listening to the UBS pit trader run the show today was astounding. Like a hungry lion with an insatiable appetite, nothing was going to get by his marching orders to lift the price at any cost. This is some really screwed up stuff if you are a realist. If you are a standard sheeple without any conscience or inclination to achieve, none of this matters to you.

I have been behind the manipulation theme for over a year now. I get it. It is real, but again my frustration boils over. This is a load of crap. This is, in the name of saving the union, destroying the fabric of our constitution. The raping of America for the glory of the banks has gone to far, and I have really had enough. It is out of control and no one is doing a damn thing to stop it. You can kiss everything you know goodbye, cause when this is over there will be nothing left. Our dignity as a nation is gone. We have been sold out.It will crash one day. There is no recovery. We have done nothing to address the core credit problems that caused this mess. They have simply prolonged the pain and suffering thru a massive waste of money (or transfer of wealth to the banks) in the name of reflation.

We have 8 (EIGHT) months of cash flow left as a nation (yes, this includes the 1.9 trillion they just extended to the treasury ceiling). Do you care to tell me where they will make up the difference when this fairy tale ends? That's right, taxes and real budget cuts and both are gonna really hurt. March 29, 2010 Total Debt Subject To Limit: $12,629,674,000,000

Care to look at the Debt Clock?

This Daily SPX charts is better viewed HERE. Look and revel in the impossible. It is occurring on this chart. View and be amazed.

S&P 500, $SPX,

I hope everyone had a good weekend. With All the action this week (see Economic Calendar below) picking a direction here would be meaningless. Sure the indicators say overbought and the economy is a total mess, but that means nothing. You have to roll with the punches. Play what the Fed and the BD's give you. You are playing their game and have to play by their rules. Easter week, so we have a short week and trading may be light.

Economic Calendar -HUGE week. With ADP Wednesday (a well timed misleading GS number thrown out some time mid weak and some more BS from the BLS), Thursday will be huge with all sorts of stuff and Friday you should know is the big jobs report.What this all adds up to is a big Monday next week IMO.

Pivot Points - Know 'em.

Permabears, keep your emotions in check.

Comparison chart - SPX, Oil, TNX and the dollar are having a party and gold has decided not to join in. The inverse relationship of SPX to the Dollar broke down back in December. The dollar has strengthened considerably and the SPX has ignore this run. This should change. A stronger dollar is not necessarily a good thing for the markets. I guess their argument now is that the price of the dollar to the market is "relative". LOL, that's funny, kinda like the price of gold being manipulated is "relative" as well.

SPX -Can they reverse the trend in the daily indicator chart? It would not surprise me. Remember this is a huge week as mentioned above, then you have to throw in the quarter ending scenario (they want to hold those balances up for a good statement print). This chart looks really bearish (like the top may be in bearish). Beauty is only skin deep though and we all know what the inside of this monster looks like.

SPX 60m - The 15 and 30m charts are oversold, the minis being up a little over 4 and price sitting on support a pop this morning should only complete the current corrective or flag/pennant that is forming.

SPX Weekly - The weekly SPX chart says that a top could be near, but it still has some strength. RSI5 is above where the market has peaked in the past and overbought. F Sto got a bear cross last week. S Sto is no longer climbing and may possibly be setting up a bear cross in the next week or two. OBV is at the point it has reversed recently. What I want you to see id the relationship between SPXA50 and the NYMO. While it is not necessary, the last several tops have been marked by a top in the SPXA50 combined with a divergence in the NYMO. This has been very reliable. If we are to get some sort of manufactured pop this week thru manipulation of the employment data that may set the divergence for the top. 5 out of the past 6 weeks up to set a higher high is impressive. Bernanke is proving his worth as possibly the best market manipulator ever (but that is really not that hard when there are no regulations or rules to play by and you have no morals).

Based on the dailys I am expecting continued weakness. Possibly a lot of weakness, BUT with the short trading week and the BS BLS coming, I MUST CAUTION the shorties about more strength in the market. I am no longer swing trading anything. It is much better to hit and run. Watch the indicators and do not be surprised at anything. Until that weekly chart confirms a trend change more upside churn is still possible.

GL!

Economic Calendar -HUGE week. With ADP Wednesday (a well timed misleading GS number thrown out some time mid weak and some more BS from the BLS), Thursday will be huge with all sorts of stuff and Friday you should know is the big jobs report.What this all adds up to is a big Monday next week IMO.

Pivot Points - Know 'em.

Permabears, keep your emotions in check.

Comparison chart - SPX, Oil, TNX and the dollar are having a party and gold has decided not to join in. The inverse relationship of SPX to the Dollar broke down back in December. The dollar has strengthened considerably and the SPX has ignore this run. This should change. A stronger dollar is not necessarily a good thing for the markets. I guess their argument now is that the price of the dollar to the market is "relative". LOL, that's funny, kinda like the price of gold being manipulated is "relative" as well.

SPX -Can they reverse the trend in the daily indicator chart? It would not surprise me. Remember this is a huge week as mentioned above, then you have to throw in the quarter ending scenario (they want to hold those balances up for a good statement print). This chart looks really bearish (like the top may be in bearish). Beauty is only skin deep though and we all know what the inside of this monster looks like.

SPX 60m - The 15 and 30m charts are oversold, the minis being up a little over 4 and price sitting on support a pop this morning should only complete the current corrective or flag/pennant that is forming.

SPX Weekly - The weekly SPX chart says that a top could be near, but it still has some strength. RSI5 is above where the market has peaked in the past and overbought. F Sto got a bear cross last week. S Sto is no longer climbing and may possibly be setting up a bear cross in the next week or two. OBV is at the point it has reversed recently. What I want you to see id the relationship between SPXA50 and the NYMO. While it is not necessary, the last several tops have been marked by a top in the SPXA50 combined with a divergence in the NYMO. This has been very reliable. If we are to get some sort of manufactured pop this week thru manipulation of the employment data that may set the divergence for the top. 5 out of the past 6 weeks up to set a higher high is impressive. Bernanke is proving his worth as possibly the best market manipulator ever (but that is really not that hard when there are no regulations or rules to play by and you have no morals).

Based on the dailys I am expecting continued weakness. Possibly a lot of weakness, BUT with the short trading week and the BS BLS coming, I MUST CAUTION the shorties about more strength in the market. I am no longer swing trading anything. It is much better to hit and run. Watch the indicators and do not be surprised at anything. Until that weekly chart confirms a trend change more upside churn is still possible.

GL!

Sunday, March 28, 2010

$SPX S&P 500 980 Target In June?

See annotations. Of course this point is so obvious that Bernanke has seen it and will most likely counter it with a move to 36,000. Enjoy your Sunday.

Friday, March 26, 2010

Welcome Juggernaut Trading

Have you ever wondered if there is a better way to trade? One that is off the charts better than any other? Well, I have found it. About two weeks ago I opened an account with Broad Street Trading, LLC and found Juggernaut Trading, LLC and Tim Kelleher in the process. A nasty combination of a sensational trading platform and experienced traders that have even transformed my trading abilities (all in two weeks).

Some of you wonder where I have been during the days for a few weeks, well, now you know. I haunt a new board comparing technical wit with a few other technicians thru the day while Tim is barking out trades and nuggets of market knowledge and movements that have really impressed me. It is an involved, active and informative journey every day. I have been able to combine my charting and tracking abilities with Tim's commentary to refine my trading and take it to new levels. To be able to take my bearish stance to a board that accepts both bull and bear arguments has opened new doors to my ability to make profits.

Tim has been a professional in electronic equities trading since 1992. Tim's experience ranges from formerly directing Instinet's data centers to operating Juggernaut Trading, LLC. Specializing in developing multiple well defined arguments in both the overall market and individual equities. Two other traders live in the background, Mark Brickman and Mark Baratto. Both seasoned veterans sporting a combined 16 years experience.

Opening the account with Broad Street Trading LLC was simple and downloading operating the trading platform even easier. Trades are lightning fast and tracking your open and closed positions is a breeze. Support is just a phone call away. Did I mention the leverage? Yeah, this place is etrade on steroids with a personal coach. It is sick.

Yeah, I forgot to mention the training platform. Tim is a personal trading coach that has designed courses for all levels of traders that are really fantastic. They give you an insider's knowledge at the tip of your fingers. They are designed for every level of trader, and trust me, with all of Tim's experience you will learn many secrets of the pits and valuable market knowledge that only comes with his years of experience. Then you get Tim all day on the board putting it all together right in front of you.

I am in an affiliate arrangement with Juggernaut and Broad Street. You know me. This is the first affiliate arrangement I have ever brought to my board to actively promote. I don't blog for money. I blog to assist others to get better and gain knowledge. Juggernaut is like that. I trust 'em and have thoroughly enjoyed trading with them. I would like for you to take advantage of the two week free trial of their trading board that you can sign up for here. I will be there every minute of the day so you know that I am not full of it. I do not get paid to be there. I am there out of my own free will. Yes, this is where I hang now. All day.

Since there is a chance I could be compensated for this referral, I would like to ask you to include my name in the section of the sign up form of where you heard about Juggernaut or Broad Street Trading. I hope to see you there. Make sure you give a shout out when you get on the board.

Welcome

Some of you wonder where I have been during the days for a few weeks, well, now you know. I haunt a new board comparing technical wit with a few other technicians thru the day while Tim is barking out trades and nuggets of market knowledge and movements that have really impressed me. It is an involved, active and informative journey every day. I have been able to combine my charting and tracking abilities with Tim's commentary to refine my trading and take it to new levels. To be able to take my bearish stance to a board that accepts both bull and bear arguments has opened new doors to my ability to make profits.

Tim has been a professional in electronic equities trading since 1992. Tim's experience ranges from formerly directing Instinet's data centers to operating Juggernaut Trading, LLC. Specializing in developing multiple well defined arguments in both the overall market and individual equities. Two other traders live in the background, Mark Brickman and Mark Baratto. Both seasoned veterans sporting a combined 16 years experience.

Opening the account with Broad Street Trading LLC was simple and downloading operating the trading platform even easier. Trades are lightning fast and tracking your open and closed positions is a breeze. Support is just a phone call away. Did I mention the leverage? Yeah, this place is etrade on steroids with a personal coach. It is sick.

Yeah, I forgot to mention the training platform. Tim is a personal trading coach that has designed courses for all levels of traders that are really fantastic. They give you an insider's knowledge at the tip of your fingers. They are designed for every level of trader, and trust me, with all of Tim's experience you will learn many secrets of the pits and valuable market knowledge that only comes with his years of experience. Then you get Tim all day on the board putting it all together right in front of you.

I am in an affiliate arrangement with Juggernaut and Broad Street. You know me. This is the first affiliate arrangement I have ever brought to my board to actively promote. I don't blog for money. I blog to assist others to get better and gain knowledge. Juggernaut is like that. I trust 'em and have thoroughly enjoyed trading with them. I would like for you to take advantage of the two week free trial of their trading board that you can sign up for here. I will be there every minute of the day so you know that I am not full of it. I do not get paid to be there. I am there out of my own free will. Yes, this is where I hang now. All day.

Since there is a chance I could be compensated for this referral, I would like to ask you to include my name in the section of the sign up form of where you heard about Juggernaut or Broad Street Trading. I hope to see you there. Make sure you give a shout out when you get on the board.

Welcome

Morning Post

Happy Friday! We all deserve a good weekend I'm sure, so let's make it happen and get it kicked off today.

GDP (Government Development Purchases) were mixed. The minis had a brief spike down and that was about it.

Economic Calendar - Sentiment at 9:55

Pivot Points -

Dailys and 60m both pretty darn bearish. After the sell off yesterday (that was largely unnoticed by the masses cause it was an up down thing) you might think it has had enough. I'm not so sure bout that. The intraday up/down yesterday had little net effect other than driving the indicators into a more bearish stance. I quite honestly don't see why SPX can't make it down to 52 or 42 in a hurry. The lower low taking out 66 was nice. 52 is the next low that needs to get dusted. There really is not much to support any fall from here to 1115.

Yesterday the minis IMHO made a better chart to signal the reversal. The divergences on the 30 and 15m to the peak were really clear and made for a well timed trade. The point of this is that you do not need to chart both, but you do need to be able eyeball the indicators and see a trend developing. We all know the market is toppy and what the dailys and 60m have to say, but to time the entries you have to dig down a little.

60m SPX -I like this chart cause it shows how we dumped out of the last wedge and hopefully it will make a good comparison for what is to come. The last wedge fall was a beauty call that I had. It is even more overbought coming into this reversal. Yesterday was just a taste of what is to come. First that 50ma needs to crack then look for the bear cross to confirm trend change.

Dollar - 60m has a divergence that says near term weakness. I have to warn you that the weeklys are overbought and a bull whipsaw is happening in an overbought S Sto.

Natgas - I may quit reporting on this till the 3.25 level, but you may get a pop anywhere between here and the 3.81 level which is the 61.8% retracement.

Oil - Trending down. Should continue to remain range bound for a while (unless a war or something).

Gold - Might churn a little while the dailys get a bottom set.

GL! Enjoy your weekend.

GDP (Government Development Purchases) were mixed. The minis had a brief spike down and that was about it.

Economic Calendar - Sentiment at 9:55

Pivot Points -

Dailys and 60m both pretty darn bearish. After the sell off yesterday (that was largely unnoticed by the masses cause it was an up down thing) you might think it has had enough. I'm not so sure bout that. The intraday up/down yesterday had little net effect other than driving the indicators into a more bearish stance. I quite honestly don't see why SPX can't make it down to 52 or 42 in a hurry. The lower low taking out 66 was nice. 52 is the next low that needs to get dusted. There really is not much to support any fall from here to 1115.

Yesterday the minis IMHO made a better chart to signal the reversal. The divergences on the 30 and 15m to the peak were really clear and made for a well timed trade. The point of this is that you do not need to chart both, but you do need to be able eyeball the indicators and see a trend developing. We all know the market is toppy and what the dailys and 60m have to say, but to time the entries you have to dig down a little.

60m SPX -I like this chart cause it shows how we dumped out of the last wedge and hopefully it will make a good comparison for what is to come. The last wedge fall was a beauty call that I had. It is even more overbought coming into this reversal. Yesterday was just a taste of what is to come. First that 50ma needs to crack then look for the bear cross to confirm trend change.

Dollar - 60m has a divergence that says near term weakness. I have to warn you that the weeklys are overbought and a bull whipsaw is happening in an overbought S Sto.

Natgas - I may quit reporting on this till the 3.25 level, but you may get a pop anywhere between here and the 3.81 level which is the 61.8% retracement.

Oil - Trending down. Should continue to remain range bound for a while (unless a war or something).

Gold - Might churn a little while the dailys get a bottom set.

GL! Enjoy your weekend.

Thursday, March 25, 2010

Boiling Over And A Big FU

At 11:45 I was so pissed off that both my HP (10bII - I hate the reverse math) and my coffee cup had left sizable marks on the wall opposite my desk. The dam melt up was happening again, and I had finally had enough to resort to throwing and yelling and blowing out about 1,000 capillaries in my cranium. I then got composed, noticed the perfect short set up and, well, I'm all happy now.

This manipulation bullshit must stop. Hell, it does not matter if it stops now or not. We're beyond toast. We're beyond friggin any measure of doom. They can't stop it. Like a crack or meth addict, the need to perpetuate the Ponzi must be driven at any cost. They are in too deep and no matter what Bernanke says about an "exit strategy", there is not one. The game is over. Do you know how hard it is to describe something that must be stopped but can't be stopped cause if it gets stopped it all collapses, but if you don't stop it it will collapse anyway? So they trudge on thinking we'll never notice (actually it has gotten so blatant that they don't give a shit if we notice or not cause the SEC is not doing a damn thing to stop it).

Please see Some Observations On SPY VWAP And Block Manipulation As FSA Launches Probe On Front-Running Of Block Trades. This is mind boggling, the lack of regulation of any sort. ZH gives the SEC their due here, "When are the useless excuses for human detritus over at the SEC going to do a comparable probe? Oh wait, they are watching kiddy and tranny porn as we speak, and counting their Wall Street salaries once they leave their cushy taxpayer subsidized offices. Sorry, go back to demanding an increase in your budget you worthless examples of reverse evolution. In the meantime, we present some obvious block manipulation data in the SPY which if we had anything remotely resembling a market regulator would be immediately probed." Apparently you can give the SEC hard data that proves manipulation or fraud (think Madoff) and they don't do squat about it. Maybe the banks fall under some GSE act now and are not punishable anymore. Shapiro need to be shown the door with the rest of her agency. This post is evidence (to me) of the PPT hard at work.

I have harped on total collapse and default for months now as the end game scenario. It is nice to finally hear it from someone else. In ECU Group's Philip Manduca "We Are At A Tipping Point" And The Only Thing That May Save The Euro Is A Collapse Of The US is a nice vid (from CNBS of all places) where Manduka discusses the tipping point, the wall of worry, loss of stimulus and debasement. If I were more civilized and proper this may be what I would sound like, but that would not be fun now would it? Please watch the vid in this post! It is going to hit the fan and it will be ugly.

Mish has 19,000 Job Cuts Projected For NYC; Illinois Bill to Slash Pensions; Florida Bill To Slash Pensions; John Dennis vs. Nancy Pelosi. Mish is really pissed at the unions, and he should be. Perhaps they are just fighting for their workers rights? Sadly, I think the union leaders exemplify the "me first" attitude that permeates America and are willfully blind to the true economic state of the Union. Give this one a read. It opens up local politics that you miss in the MSM (Hmmm, wonder why?). The best part of this post is, get this, DO YOU WANT PELOSI OUT? well, here is your chance John Dennis Deserves your support. Hit that link, faccebook it, tweet it get the word out. Vote in John Dennis! LOL - Today is Pelosi's birthday. Please send a gift to John Dennis her opponent to wish her well on her way out of office.

Friggin dig this BS. The battle over your 401(k) assets is getting heated up. First the government was (and still is) considering forcing you to buy treasuries with the funds, now get a load of this Bend Over America: Now The SEIU Wants Your 401k! Nah, forget all those nasty things Mish just said about the unions being greedy and self absorbed, I think they are the spawn of the devil and Mish may have been to kind. "One of the nation's largest labor unions, the Service Employees International Union (SEIU), is promoting a plan that will centralize all retirement plans for American workers, including private 401(k) plans, under one new "retirement system" for the United States." Let me say it for you may I, FUCK YOU! You now have two potential reasons to see a mass exodus out of the 401(k) market (well, excluding the 20 million other reasons some have already left their plans). Let me say it again, FUCK YOU SEIU!

naked capitalism has Top ten reasons you know China has a financial bubble on its hands. I found this one quite humorous.

Frustrations aside, it wound up being a good day. Sadly reveling in creating wealth from the collapse of this once great nation is a little lopsided. Well, hey, they created the standard. At least I'm gonna do it legally and with transparency. Hang on. It is gonna be a wild ride. Remember when I discussed the potential need for ammo and seeds, yeah, we're getting closer. Great Depression v.II is coming.

This manipulation bullshit must stop. Hell, it does not matter if it stops now or not. We're beyond toast. We're beyond friggin any measure of doom. They can't stop it. Like a crack or meth addict, the need to perpetuate the Ponzi must be driven at any cost. They are in too deep and no matter what Bernanke says about an "exit strategy", there is not one. The game is over. Do you know how hard it is to describe something that must be stopped but can't be stopped cause if it gets stopped it all collapses, but if you don't stop it it will collapse anyway? So they trudge on thinking we'll never notice (actually it has gotten so blatant that they don't give a shit if we notice or not cause the SEC is not doing a damn thing to stop it).

Please see Some Observations On SPY VWAP And Block Manipulation As FSA Launches Probe On Front-Running Of Block Trades. This is mind boggling, the lack of regulation of any sort. ZH gives the SEC their due here, "When are the useless excuses for human detritus over at the SEC going to do a comparable probe? Oh wait, they are watching kiddy and tranny porn as we speak, and counting their Wall Street salaries once they leave their cushy taxpayer subsidized offices. Sorry, go back to demanding an increase in your budget you worthless examples of reverse evolution. In the meantime, we present some obvious block manipulation data in the SPY which if we had anything remotely resembling a market regulator would be immediately probed." Apparently you can give the SEC hard data that proves manipulation or fraud (think Madoff) and they don't do squat about it. Maybe the banks fall under some GSE act now and are not punishable anymore. Shapiro need to be shown the door with the rest of her agency. This post is evidence (to me) of the PPT hard at work.

I have harped on total collapse and default for months now as the end game scenario. It is nice to finally hear it from someone else. In ECU Group's Philip Manduca "We Are At A Tipping Point" And The Only Thing That May Save The Euro Is A Collapse Of The US is a nice vid (from CNBS of all places) where Manduka discusses the tipping point, the wall of worry, loss of stimulus and debasement. If I were more civilized and proper this may be what I would sound like, but that would not be fun now would it? Please watch the vid in this post! It is going to hit the fan and it will be ugly.

Mish has 19,000 Job Cuts Projected For NYC; Illinois Bill to Slash Pensions; Florida Bill To Slash Pensions; John Dennis vs. Nancy Pelosi. Mish is really pissed at the unions, and he should be. Perhaps they are just fighting for their workers rights? Sadly, I think the union leaders exemplify the "me first" attitude that permeates America and are willfully blind to the true economic state of the Union. Give this one a read. It opens up local politics that you miss in the MSM (Hmmm, wonder why?). The best part of this post is, get this, DO YOU WANT PELOSI OUT? well, here is your chance John Dennis Deserves your support. Hit that link, faccebook it, tweet it get the word out. Vote in John Dennis! LOL - Today is Pelosi's birthday. Please send a gift to John Dennis her opponent to wish her well on her way out of office.

Friggin dig this BS. The battle over your 401(k) assets is getting heated up. First the government was (and still is) considering forcing you to buy treasuries with the funds, now get a load of this Bend Over America: Now The SEIU Wants Your 401k! Nah, forget all those nasty things Mish just said about the unions being greedy and self absorbed, I think they are the spawn of the devil and Mish may have been to kind. "One of the nation's largest labor unions, the Service Employees International Union (SEIU), is promoting a plan that will centralize all retirement plans for American workers, including private 401(k) plans, under one new "retirement system" for the United States." Let me say it for you may I, FUCK YOU! You now have two potential reasons to see a mass exodus out of the 401(k) market (well, excluding the 20 million other reasons some have already left their plans). Let me say it again, FUCK YOU SEIU!

naked capitalism has Top ten reasons you know China has a financial bubble on its hands. I found this one quite humorous.

Frustrations aside, it wound up being a good day. Sadly reveling in creating wealth from the collapse of this once great nation is a little lopsided. Well, hey, they created the standard. At least I'm gonna do it legally and with transparency. Hang on. It is gonna be a wild ride. Remember when I discussed the potential need for ammo and seeds, yeah, we're getting closer. Great Depression v.II is coming.

Morning Post

Nothing like coming in to the office and having the e-minis at higher highs.I'm not sure if some of the focus needs to shift to the action in bonds or currencies, but they need to be watched more closely. How they allow Liesman to continue spouting his crap every morning is beyond me.

Economic calendar - Busy day. Jobs at 8:30, Bernanke at 10, Natgas at 10:30, auctions and then Timmaayyy at 1:30

Pivot Points - Know 'em.

Comparing the indexes - Looks like a well coordinated charge to take the hill.

SPX Daily - The push in the minis is somewhat surprising (is it really?). As I indicated in the E-mini post below "See if it gets pinched off running the upper pink TL and green support line here then reverses". Well we're nearing that point of recognition climbing the lower green support line and nearing the upper pink resistance line (LOL - resistance lines, those are so 1970's).

The daily chart below says we should have started falling three days ago. No, I did not call it, just noted where my signals would have normally triggered a sell or top call. The divergence in the RSI5 has further confirmed (possibly - trying to call anything in this market to go down can be a severe CLM these days) those signals.

SPX weekly - Now, this chart may not nail it to the day, but it should nail it. For the big turn you all know I am simply waiting on RSI14 to cross that red support line. Follow the red lines that mark the tops. So far on this climb every turn has been marked by the SPXA50 being over 400 and a nice divergence in the NYMO. This is not necessary, but it has trended that way. With the way RSI5, CCI and OBV are acting (busting solid divergence lines), that says to me this is the final blow off top.

SPX 60m (for good measure) - Wedges ending with overthrows. Now all those red circles are gonna get nixed this am with the minis where they are as the gap up ramp job pump and dump continues.

Now you may ask, Shanky, how the hell are you not just jumping up and down screaming top and sell? Simple, this is a manipulated bullshit market. I do think we sell off today, but two problems exist. 1) The banks need more capital, so they may leak it down for the last grab. The last push for survival and the last plunge in Americas ass to complete the rape job of the middle class. They have to keep sentiment positive thru that push/thrust. 2) They need some nice QE prints on those statements to keep the normal investors in the dark and for one last giant fee grab.

They may not be able to control the markets anymore. The issues with the PIIGS may be getting out of hand. We are so close to a DEFCON 5000 meltdown. Be patient. Let it come to you. Laugh in their face, cause you know their game. They have slipped up. Their money grab got out of control cause they could not control the surging greed. Now they will pay. Game over. Sadly they destroyed a great nation in the process.

The bond markets and FX are showing serious signs of cracking. The stress levels are super high. Keep an eye on TBT. Might be about to break out. Had a "slight" volume buying spike yesterday. I think we'll start seeing some huge dumps here very soon. I am very tempted to call a top if not the top (yes, we're getting near that point in time) at the open based on the position of the minis, but we need to let it play out. Further upside really is unfathomable at these levels, but then again I said that back in April of last year.

GL!

Economic calendar - Busy day. Jobs at 8:30, Bernanke at 10, Natgas at 10:30, auctions and then Timmaayyy at 1:30

Pivot Points - Know 'em.

Comparing the indexes - Looks like a well coordinated charge to take the hill.

SPX Daily - The push in the minis is somewhat surprising (is it really?). As I indicated in the E-mini post below "See if it gets pinched off running the upper pink TL and green support line here then reverses". Well we're nearing that point of recognition climbing the lower green support line and nearing the upper pink resistance line (LOL - resistance lines, those are so 1970's).

The daily chart below says we should have started falling three days ago. No, I did not call it, just noted where my signals would have normally triggered a sell or top call. The divergence in the RSI5 has further confirmed (possibly - trying to call anything in this market to go down can be a severe CLM these days) those signals.

SPX weekly - Now, this chart may not nail it to the day, but it should nail it. For the big turn you all know I am simply waiting on RSI14 to cross that red support line. Follow the red lines that mark the tops. So far on this climb every turn has been marked by the SPXA50 being over 400 and a nice divergence in the NYMO. This is not necessary, but it has trended that way. With the way RSI5, CCI and OBV are acting (busting solid divergence lines), that says to me this is the final blow off top.

SPX 60m (for good measure) - Wedges ending with overthrows. Now all those red circles are gonna get nixed this am with the minis where they are as the gap up ramp job pump and dump continues.

Now you may ask, Shanky, how the hell are you not just jumping up and down screaming top and sell? Simple, this is a manipulated bullshit market. I do think we sell off today, but two problems exist. 1) The banks need more capital, so they may leak it down for the last grab. The last push for survival and the last plunge in Americas ass to complete the rape job of the middle class. They have to keep sentiment positive thru that push/thrust. 2) They need some nice QE prints on those statements to keep the normal investors in the dark and for one last giant fee grab.

They may not be able to control the markets anymore. The issues with the PIIGS may be getting out of hand. We are so close to a DEFCON 5000 meltdown. Be patient. Let it come to you. Laugh in their face, cause you know their game. They have slipped up. Their money grab got out of control cause they could not control the surging greed. Now they will pay. Game over. Sadly they destroyed a great nation in the process.

The bond markets and FX are showing serious signs of cracking. The stress levels are super high. Keep an eye on TBT. Might be about to break out. Had a "slight" volume buying spike yesterday. I think we'll start seeing some huge dumps here very soon. I am very tempted to call a top if not the top (yes, we're getting near that point in time) at the open based on the position of the minis, but we need to let it play out. Further upside really is unfathomable at these levels, but then again I said that back in April of last year.

GL!

Wednesday, March 24, 2010

E-mini 30m

Kind of cryptic, but see if you get where I am going with this.

Bears - If it can crack that green support line right here then get thru the 50% line of the pink channel the bears may make it to to 50 to 47 area again. If the pink line goes you are looking at 1112. One would think that the recent divergence in the daily RSI would signal a bigger reversal is coming. (One would logically assume such action, but in this market you never know - that may be bullish LOL).

Bulls - If the green line holds or the cream dashed support line below it the march can continue.

Bottom line is we're in a really peculiar area right here. See if this run is finally about to roll over and about to break to the right (switch from Green to Pink). See if it gets pinched off running the upper pink TL and green support line here then reverses or if the yellow channel holds. These are just me thinking out loud. I think the 60m has some more downward pressure to work.The fibs are 56, 52 and 47 for this run. 52 and 47 would have to hit Friday if the yellow channel actually is in play. The 61 area is key support here.

Bears - If it can crack that green support line right here then get thru the 50% line of the pink channel the bears may make it to to 50 to 47 area again. If the pink line goes you are looking at 1112. One would think that the recent divergence in the daily RSI would signal a bigger reversal is coming. (One would logically assume such action, but in this market you never know - that may be bullish LOL).

Bulls - If the green line holds or the cream dashed support line below it the march can continue.

Bottom line is we're in a really peculiar area right here. See if this run is finally about to roll over and about to break to the right (switch from Green to Pink). See if it gets pinched off running the upper pink TL and green support line here then reverses or if the yellow channel holds. These are just me thinking out loud. I think the 60m has some more downward pressure to work.The fibs are 56, 52 and 47 for this run. 52 and 47 would have to hit Friday if the yellow channel actually is in play. The 61 area is key support here.

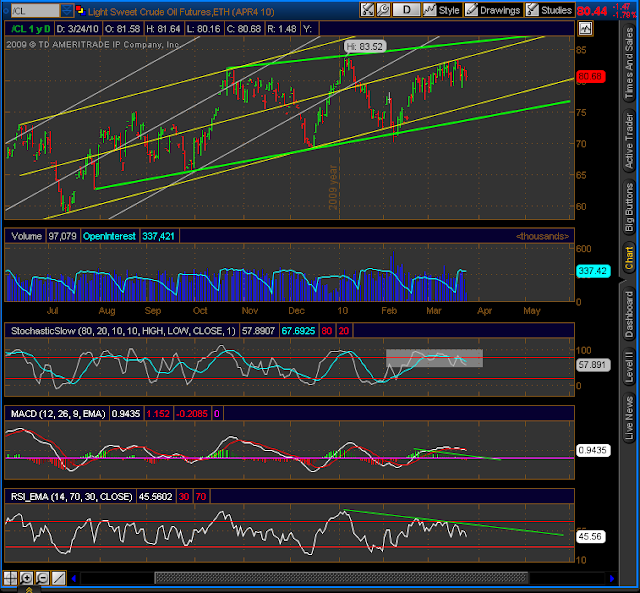

/CL Light Sweet Crude (Texas Tea)

Quick chart - trending down. Looks toppy to me. No troubles in the middle east to scare prices higher at this time. Possible H&S reversal forming, but don't count on it.

EIA link HERE

EIA link HERE

EUR/USD

Monthly chart - Indicators show no strength here. From the '01 low to the '08 high it formed a channel. Then a collapse to the 50% retracement (gray box) in '08. That set the yellow TL. The rise to backtest the channel and now cracking the 61.8% retracement of the rise in '09 as it channels down.

Daily chart - The gray box is the retracement zone surrounding the 50 to 61.8% retracement. That crack of the 1.34 level is surprising. Let's see if she wants that lower longer term yellow support line or the gray one below that.

$DXY is gapping up this morning. You all know that I have been torn with the dollar being in an ABC corrective or something larger with an $89 target. At this time, if the rest of the world is going to collapse someone has to go up (that would be the greenback). Have no fear, it will collapse eventually as well.This chart has room to run.

Daily chart - The gray box is the retracement zone surrounding the 50 to 61.8% retracement. That crack of the 1.34 level is surprising. Let's see if she wants that lower longer term yellow support line or the gray one below that.

$DXY is gapping up this morning. You all know that I have been torn with the dollar being in an ABC corrective or something larger with an $89 target. At this time, if the rest of the world is going to collapse someone has to go up (that would be the greenback). Have no fear, it will collapse eventually as well.This chart has room to run.

Morning Post

Portugal takes one on the chin, but the overbought stratospheric market will apparently shake it off. Apparently just a flesh wound. The minis fell hard right to the support line I showed you yesterday morning that runs up from the last major low at 1042.

Economic Calendar - New homes at 10 and Petrol at 10:30

Pivot Points -

I'm struggling with the call this morning. The choppy topping action, consolidation and severe overbought conditions are wearing on me a little bit. Last night I actually started tinkering with some (most likely premature) topping lines on a few charts. Even before I heard the Portugal news I was leaning down today for some reason. The charts are getting really ugly and hard to get a grip on especially on an intraday basis. While my gut is usually very good, you can't trust in anything other than the GS bots runnin and gunnin this market for all it is worth. You have to remain with the trend till it is proven busted.

The choppy consolidation broke out nicely when resistance was breached. SPX put in a massively bullish 60m candle, and I'm not sure that the breakout can be ignored (not really sure if it can be trusted either). That said, you gotta keep on riding the train. Support has been laid on the SPX at numerous levels in the past week. Resistance is futile now at new highs. She may be flying above the clouds here with a tail wind. Maybe she'll run to 1214 and just get it over with finally. Sorry for the confusion this am. Not sure if emotions are taking over or if my alter ego is popping up (no you're not, yes I am, no you're not, yes I am).If we stick with the charts we will not be misled. It is getting hard playing with longs, cause you know you are playing with fire up here. If you play shorties, please don't be a moron and accept huge losses. Have a plan. Set a stop. Take you losses and walk away. Live to fight another day. If you are long, enjoy it while it lasts, you to will need an exit plan soon as well.

SPX Tops and Bottoms Chart - This will allow you so comb thru a ton of info and see what the indicators should show at the major buy and sell levels for the past few years. We are very close. GL!

CHART BEST VIEWED AT THIS LINK HERE

Economic Calendar - New homes at 10 and Petrol at 10:30

Pivot Points -

I'm struggling with the call this morning. The choppy topping action, consolidation and severe overbought conditions are wearing on me a little bit. Last night I actually started tinkering with some (most likely premature) topping lines on a few charts. Even before I heard the Portugal news I was leaning down today for some reason. The charts are getting really ugly and hard to get a grip on especially on an intraday basis. While my gut is usually very good, you can't trust in anything other than the GS bots runnin and gunnin this market for all it is worth. You have to remain with the trend till it is proven busted.

The choppy consolidation broke out nicely when resistance was breached. SPX put in a massively bullish 60m candle, and I'm not sure that the breakout can be ignored (not really sure if it can be trusted either). That said, you gotta keep on riding the train. Support has been laid on the SPX at numerous levels in the past week. Resistance is futile now at new highs. She may be flying above the clouds here with a tail wind. Maybe she'll run to 1214 and just get it over with finally. Sorry for the confusion this am. Not sure if emotions are taking over or if my alter ego is popping up (no you're not, yes I am, no you're not, yes I am).If we stick with the charts we will not be misled. It is getting hard playing with longs, cause you know you are playing with fire up here. If you play shorties, please don't be a moron and accept huge losses. Have a plan. Set a stop. Take you losses and walk away. Live to fight another day. If you are long, enjoy it while it lasts, you to will need an exit plan soon as well.

SPX Tops and Bottoms Chart - This will allow you so comb thru a ton of info and see what the indicators should show at the major buy and sell levels for the past few years. We are very close. GL!

CHART BEST VIEWED AT THIS LINK HERE

Tuesday, March 23, 2010

I'm Stunned (I Shouldn't Be But I Am)

No, not that the HC bill got signed (stupid stuff like that happens every day - I believe something like 37 states are already moving with regulation to fight the HC bill). I'm actually stunned at the melt up today. Yeah, I know, I called it this morning, but that does not mean that I can't be annoyed buy the perpetual Ponzi market.

The bulls are so fat and happy with their bloated statements that they will push anything higher that GS or JPM tell them to. As long at the BS BLS, CNBS and the MSM keep on reporting the "news" and "figures" this melt job will never end. Heck, even O's approval rating is up 7 points in the last 5 days. Hell, they will ramp anything these days. With insolvent banks, bankrupt states and 20% unemployment who gives a shit as the No Volume Meltup Continues, Just 251 More Days Until Dow 36,000.

Please see Top Analyst: "Developed Market Governments Are Insolvent By Any Reasonable Definition". Really anyone (other than those that work for the Fed or Treasury that could not see the last bubble(s) coming) should be able to see this next bubble, but you would not know it based on the markets ramp job. "In other words, by assuming huge portions of the risk from banks trading in toxic derivatives, and by spending trillions that they don't have, central banks have put their countries at risk from default." SocGen's Dylan Grice (yes, this is basically from a TBTF analyst) has this to say, "Eventually, there will be a crisis of such magnitude that the political winds change direction, and become blustering gales forcing us onto the course of fiscal sustainability. Until it does, the temptation to inflate will remain, as will economists with spurious mathematical rationalizations as to why such inflation will make everything OK . Until it does, the outlook will remain favorable for gold. But eventually, majority opinion will accept the painful contractionary medicine because it will have to. That will be the time to sell gold."

Washington's blog also has 72% of Democrats, 84% of Republicans and 80% of Independents Think the Economy Could Collapse in case you are interested.

Another stunner - David Einhorn Slams SEC, Says Its Culture Of "Lawlessness" That Allowed Allied Capital's Fraud Cannot Continue. What, who is he fooling? Regulation would spoil everything. Of course the culture of lawlessness will continue. Well, till the total collapse and rape of the middle class is complete, then there will be nothing left except for them to feed upon themselves.

Mish analyzes one of Denninger's earlier posts in Bernanke Wants to End Bank Reserve Requirements Completely: Does it Matter? What Chaos will Result? End reserve requirements? you got that. Reserves are YOUR DEPOSITS. That means they don't have to keep anything in the bank (like your money). The end answer is "Exactly the kind of banking chaos we have already seen! Nothing has changed. Expect more chaos because it is coming." The post does a nice job of explaining the expansion of the money supply, fractional reserves and how your money every night disappears and wonders off to lala land to grow. This is really screwed up. Sure, we're supposed to "trust" them that if I want to go get my $100k out of the bank it will "be there". Shuh...

Denninger is on a roll today. Lots of short and saweet posts hammering everything. Now we have this wonderful bill that will make everything better (shuh...right, maybe for the insurance companies and related industries). Have you gotten your rate increase yet? This dude has in That Didn't Take Long.... Just wait till April 01. "If your value in the marketplace is $20/hour, with a 2,000 hour man-year of work (50 weeks x 40 hours/week) your economic value in the economy is $40,000 (gross.) From this your employer is going to have to take $10,000 out to avoid being fined, which means you now make $15/hour. Then you pay taxes (FICA and Medicare) on that. You'll likely get back the rest of your federal income tax (especially if you have a family) but your out-of-pocket medical expenses will still be that $10,000 either way." So, this will encourage hiring and lower costs to you and me? the estimates on increased taxes range from $500B to $1.2T. This is just the medicine the "recovered" economy needed right now. This one will backfire badly.

I'm stunned actually cause they are finding ways to make things worse. Massive deflation is coming (Inflation? Where?), then I believe global default is coming (they are setting it up with little things like "no reserve requirements"). It will be the only solution. If you live in a state that gives you your tax refund in the form of an IOU, congratulations, you are on the cusp of devastation. If you live in one of the PIIGS (that we may be bailing out with our tax dollars) you know what I am talking about. If you are a sheltered sheeple watching the MSM, you have not clue how bad it is out there. The unmentioned derivatives market will implode and then QUADrillions will become the word of the day. Something tells me we won't be able to treat that like the advance from millions to billions to trillions. There will be only one way out, but in the mean time move a long, nothing to see here.

Gerald Celente Predicts "Crash of 2010"

The bulls are so fat and happy with their bloated statements that they will push anything higher that GS or JPM tell them to. As long at the BS BLS, CNBS and the MSM keep on reporting the "news" and "figures" this melt job will never end. Heck, even O's approval rating is up 7 points in the last 5 days. Hell, they will ramp anything these days. With insolvent banks, bankrupt states and 20% unemployment who gives a shit as the No Volume Meltup Continues, Just 251 More Days Until Dow 36,000.

Please see Top Analyst: "Developed Market Governments Are Insolvent By Any Reasonable Definition". Really anyone (other than those that work for the Fed or Treasury that could not see the last bubble(s) coming) should be able to see this next bubble, but you would not know it based on the markets ramp job. "In other words, by assuming huge portions of the risk from banks trading in toxic derivatives, and by spending trillions that they don't have, central banks have put their countries at risk from default." SocGen's Dylan Grice (yes, this is basically from a TBTF analyst) has this to say, "Eventually, there will be a crisis of such magnitude that the political winds change direction, and become blustering gales forcing us onto the course of fiscal sustainability. Until it does, the temptation to inflate will remain, as will economists with spurious mathematical rationalizations as to why such inflation will make everything OK . Until it does, the outlook will remain favorable for gold. But eventually, majority opinion will accept the painful contractionary medicine because it will have to. That will be the time to sell gold."

Washington's blog also has 72% of Democrats, 84% of Republicans and 80% of Independents Think the Economy Could Collapse in case you are interested.

Another stunner - David Einhorn Slams SEC, Says Its Culture Of "Lawlessness" That Allowed Allied Capital's Fraud Cannot Continue. What, who is he fooling? Regulation would spoil everything. Of course the culture of lawlessness will continue. Well, till the total collapse and rape of the middle class is complete, then there will be nothing left except for them to feed upon themselves.