Amazing. Like 1040 has the clap or something. Run away! Run away! Just like in the vid, the cave is the elusive 1040 level, the bunny is Shalom, all the bones at the mouth of the cave represent the short carnage that have dared to try the opening and the wise man with the warnings in the funny hat with the horns is Tyler Durden from ZH. 1040! Run Away! Run Away! What a joke this market is.

ZH bring us Victory For The Fed As 10K Holds; Volume Surges On Unchanged Market "Calling this robotic farce a shitshow is an insult to shit and to show." and The Last Minute Ramp Job Dissected, those two explain a lot. They can't battle and hold this level for ever, can they?

Mish has a nice post in 26 of Last 88 Trading Days have been 90% Days (Either Up or Down); 7 More Lean Years in Stock Market? another useful post that assist in dissecting the trading patterns."Today, the 1040 level on the S&P held for about the 8th time on "fabulous" news consumer confidence rose to 53. Bear in mind number in the 70's are typical of recession lows." and more information from Art Cashin on his cycle analysis are worth the look. A few more amusing facts from Mish appear in Movie Attendance Drops to 1997 Level; Case-Shiller Home Prices Rise; Last Hurrah for Housing Did we forget Consumer Confidence and Case-Shiller this morning? What you will NOT hear from Liesman CNBS is, "Case-Shiller is a backward looking index. The increasing number of foreclosures, the complete collapse in new home sales, a massive increase in inventory, and the end of tax credits all suggest we are near the end of the line for this bounce in home prices."

Denninger does a better job ripping the Case-Shiller numbers to shreds in Home Prices Respond To Government Cheese. "There's a lesson in here for the government, in that these sorts of "pull forward demand" games are only of "benefit" for as long as they continue, and as soon as that program ends (and all such programs must end, since the "freebie money" isn't infinite either) you create a worse dislocation than you originally had, as the entirety of the distortion you created now has come back out of the market along with whatever the natural progress originally was!" We shall see that in the months to come. We'll also see the lies in the "revisions" and data manipulation come to life as well. you can only revise and beat (like on GDP) so many times before you get caught with your hand in the cookie jar.

Denninger also has his usual hilarious response to the FOMC minutes in FOMC Minutes For August 10th, "Translation: There was no recovery. Not now, not before, and certainly not on a forward basis." This one hits home more than some in the past. It the fed spoke the truth, this is what you would hear.

I have often told you that you need to have gobs of cash at home ready for the next run on the banks (that don;t actually have any cash). I don't care if it is in a mattress or cans or a safe (I'd store it and your guns and gold in separate places and preferably bury them somewhere). Well, The Death Of Cash? All Over The World Governments Are Banning Large Cash Transactions from The Economic Collapse should drive this point home. "Should we just accept that we have entered a time when the government will watch, track and trace all financial transactions? Is it inevitable that at some point in the near future ALL transactions will go through the banking system in one form or another (check, credit card, debit card, etc.)?" Want to learn what type of transactions you'll get locked up for? Read on.

We all have heard how much money is in the coffers of the banks and big businesses. We have all heard of the potential for M&A activity in the coming months (or currently happening). I am of the opinion that there will have to be consolidation and it will happen at much lower prices (cause the CEO's know how bad it is out there). What does consolidation and M&A activity lead to? Efficiencies, thus reducing redundant jobs is a comin with it. Washington's Blog has a great take on M&A and QEII that you need to look at in Quantitative Easing Won't Help the Economy, But Will Just Create Another Wave of Mergers and Acquisitions. "What's needed has been obvious to independent observers for years: Break up the big banks, prosecute the criminals whose fraud caused the financial crisis, and restore the rule of law and transparency. Until those basic steps are taken, nothing else will work to fix our broken economy."

That is enough for now. As for the market calls, it is getting increasingly difficult to read the charts when you are range bound in a rigged market. I may as well just say support at 1040 and resistance near 70. Eventually the support levels will crack. They are obviously defending the psychological 10k level on the DOW, but how long can they keep this charade up? I believe a crack of that level will be the last straw and you'll begin to see even more MF outflows from the masses. With 16 weeks in the books of cash moving out of the markets, something has to give sooner than later.

GL out there and thanks for your support.

Tuesday, August 31, 2010

Morning Post, SPX, S&P 500, E-mini

Charts look weak overall, but I have to caution that the 30m minis and the 30m SPX are on the same page both bottoming. Is Ben scheduled to peak this morning? This could be an incredibly bearish move this morning if they can pull it thru the 37 number on the minis and the 40 level on SPX. Never discount the PPT and "their" willingness to save this market. My thoughts are that they have spent a lot of time and effort at these levels and it may be time for them to "let" it slip another notch. Could we have some surprise data today? Don't be surprised if we do cause remember who pays the data source's paycheck (kinda like watching CNBS if you know what I mean). Woops - Case-Shiller just delivered one for the bulls - If you think home prices are rising in markets that can't sell homes over $750k I have some oceanfront property in AZ you really must buy.

Economic Calendar - Case-Shiller delivers one for the green team and the SPX futures pop 4 to gap resistance on the announcement. Chicago PMI and Cons Conf to come. The rest of the data this week should be simply horrific.

SPX weekly - 940 range target box is set (pink) to end 1 of 3. May be to far out in time, but it is what I'm thinking. Mid October to mid November. Not very aggressive. I like the number and not so much the time.CHART BETTER VIEWED HERE

Gobs of data this week. You can't trust a word they say (like the Case-Shiller number this morning). Remember who pays the bills! Minis moving up aggressively off the lows this morning. Both the 30m minis and 30m SPX are bottoming which usually leads to a pop. With Chicago PMI and Cons Conf coming out after the open it could get interesting. I was calling for a gap thru the 1040 level and they may not disappoint. Every day this week we have possible horrific data points. That 940 level could be reached by Friday (no, not kidding).

Ya think our government could take some clues from the Chinese as to how they treat financial heads of state that make horrific decisions?

Lookout below, but keep an eye on those 30m indicators. Some surprise bullishness could be in store.

Don't forget Shanky's Dark Side where I call the market intraday.

GL and thanks for the support.

Economic Calendar - Case-Shiller delivers one for the green team and the SPX futures pop 4 to gap resistance on the announcement. Chicago PMI and Cons Conf to come. The rest of the data this week should be simply horrific.

SPX weekly - 940 range target box is set (pink) to end 1 of 3. May be to far out in time, but it is what I'm thinking. Mid October to mid November. Not very aggressive. I like the number and not so much the time.CHART BETTER VIEWED HERE

Gobs of data this week. You can't trust a word they say (like the Case-Shiller number this morning). Remember who pays the bills! Minis moving up aggressively off the lows this morning. Both the 30m minis and 30m SPX are bottoming which usually leads to a pop. With Chicago PMI and Cons Conf coming out after the open it could get interesting. I was calling for a gap thru the 1040 level and they may not disappoint. Every day this week we have possible horrific data points. That 940 level could be reached by Friday (no, not kidding).

Ya think our government could take some clues from the Chinese as to how they treat financial heads of state that make horrific decisions?

Lookout below, but keep an eye on those 30m indicators. Some surprise bullishness could be in store.

Don't forget Shanky's Dark Side where I call the market intraday.

GL and thanks for the support.

Monday, August 30, 2010

Morning Post, SPX, S&P 500, E-mini

Not sure where to start this morning. I guess the bottom line is that Uncle Benny has promised to make it all good and reinforces that he can manipulate markets and economies to prosperity again (no worries about the next bubble of course), so the market loves it. How do you invest in a market where the fundamentals are some of the worst in history, but the Fed has promised to use every means possible to manipulate it? You can't.

We all witnessed what can happen when all the bulls, POMO funds, the bots and the Fed all get on the same page earlier this year. I don't think that extreme can happen again, but you must remember that the markets are not real and are being supported by invisible forces (especially at the 1040 level). I think it is game over and they are out of bullets. Plan A (spend), B (spend more and allow accounting fraud) and C (spend even more, more fraud and monetization) have failed. Now they will control the data points coming out with even more diligence and throw out selective soundbites that are really meaningless (like Ben's last Friday morning) at key moments of support. It should become relatively predictable.

Friday I was astounded that INTC lowered estimates and then closed green. If that was not a load of crap I'm not sure what is. If you remember the fall in May was full of lowered estimates that only lead to beats last quarter. I expect more of the same prior to earnings next quarter.

Economic Calendar - Tomorrow is a big day with Case Shiller, Chicago PMI and Consumer Confidence. Actually, this week may prove to be a minefield of data points.

SPX 30m - So, is price backtesting the neckline and about to collapse or is the larger wedge playing out and a slightly more significant pop is in order? Given the oversold daily indicators, I'm inclined to think we get more of a pop. but that is not guaranteed and they can begin to embed here. It all depends on the data this week. If data continues to come in at a substandard rate then Earl may not be the only storm that might hit the east coast this week.

Given the position of the indicators, I'm inclined to call for a melt up Monday. After today I'm not willing to call anything just yet. Friday should have proven to the bears that you can anticipate bad (actually horrific) data all you want yet get burned at the same time from the breath of Ben. I still contend that you have to play this market by the 30m charts with short plays and plenty of dry powder. You want to be ready for the drive thru 1040. I don't think it creeps thru that level. I think it will gap thru. Then you want to get on the train. I believe you almost have to be more reactive to this market (as being proactive and on the burned side of the trade). The minis 30m are bottoming and the SPX 30m is toppy, but has some room to climb. Let's see if they can put some more cushion under price today before the data flows later this week.

GL this week and don't forget I call the action live at Shanky's Dark Side. Let me give everyone a huge thank you as the blog crossed the 700k hit mark over the weekend.

We all witnessed what can happen when all the bulls, POMO funds, the bots and the Fed all get on the same page earlier this year. I don't think that extreme can happen again, but you must remember that the markets are not real and are being supported by invisible forces (especially at the 1040 level). I think it is game over and they are out of bullets. Plan A (spend), B (spend more and allow accounting fraud) and C (spend even more, more fraud and monetization) have failed. Now they will control the data points coming out with even more diligence and throw out selective soundbites that are really meaningless (like Ben's last Friday morning) at key moments of support. It should become relatively predictable.

Friday I was astounded that INTC lowered estimates and then closed green. If that was not a load of crap I'm not sure what is. If you remember the fall in May was full of lowered estimates that only lead to beats last quarter. I expect more of the same prior to earnings next quarter.

Economic Calendar - Tomorrow is a big day with Case Shiller, Chicago PMI and Consumer Confidence. Actually, this week may prove to be a minefield of data points.

SPX 30m - So, is price backtesting the neckline and about to collapse or is the larger wedge playing out and a slightly more significant pop is in order? Given the oversold daily indicators, I'm inclined to think we get more of a pop. but that is not guaranteed and they can begin to embed here. It all depends on the data this week. If data continues to come in at a substandard rate then Earl may not be the only storm that might hit the east coast this week.

Given the position of the indicators, I'm inclined to call for a melt up Monday. After today I'm not willing to call anything just yet. Friday should have proven to the bears that you can anticipate bad (actually horrific) data all you want yet get burned at the same time from the breath of Ben. I still contend that you have to play this market by the 30m charts with short plays and plenty of dry powder. You want to be ready for the drive thru 1040. I don't think it creeps thru that level. I think it will gap thru. Then you want to get on the train. I believe you almost have to be more reactive to this market (as being proactive and on the burned side of the trade). The minis 30m are bottoming and the SPX 30m is toppy, but has some room to climb. Let's see if they can put some more cushion under price today before the data flows later this week.

GL this week and don't forget I call the action live at Shanky's Dark Side. Let me give everyone a huge thank you as the blog crossed the 700k hit mark over the weekend.

Friday, August 27, 2010

Morning Post, SPX, S&P 500, E-mini

1.6! Let's celebrate that it was better than 1.3! Never mind the housing or employment or manufacturing or inventory data that we have seen. That's pitiful and the markets sling 4 points up to 54. Shalom's speech at 10:00 may be the big mover. Given all the data for the past month can anyone out there explain to me why the markets are not acting rationally, you know besides the fact they are rigged, POMO funded, front run and void of retail investors? I'm not sure how far they can push the fraud and manipulation, but they will eventually drive the train over the cliff. Sadly by then it will be to late to save anything. I will have to enroll in anger management classes before this is all over.

Minis this morning are now up 4 and not moving. All that anticipation for a dud? Let's hope not. Halted at 54 resistance. Lord help the day traders if they don't get a gap to trade around this morning.

Minis daily - Range bound from 27 to 42 and channeling down. Sadly at this support level I'm beginning to doubt if the bears can pull it thru. I have little faith in the bulls to be able to mount any sort of significant rally either, thus you get that line in the sand near 70. It has been a fools game for some time now. At least going up it was 100% predictable every morning, now that "they" are losing and the public has left the markets what should be is not reality. I'm not copping out, I'm just stating what I believe reality is. Without the LEH type event they will be able to suspend valuations perpetually and that is what you are witnessing here. More POMO please!

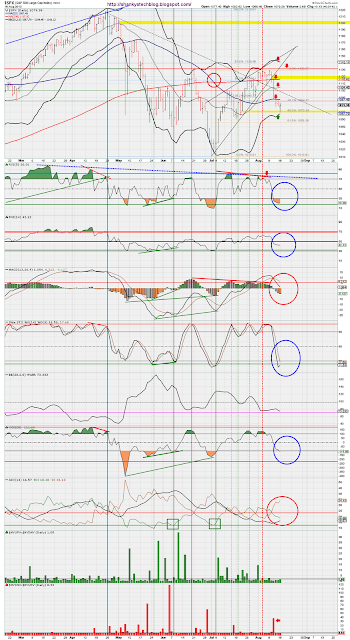

SPX daily chart - I'm real interested in that possible 20/50 bear cross that may be coming soon (orange box). That would not be good for the bulls. On the other hand markets are becoming NT oversold. The bears have not shown the leadership necessary to be able to drag this market down to the levels it deserves. You can't ask for any better data if you are a bear and what has it gotten you this week? 25 points on the minis and a market that is popping on a horrific GDP number. Housing, employment, GDP and a plethora of other bad data continues to be shrugged off. There is no other way to describe this than saying bullshit. Maybe retail is dead and all that is left are the bots controlling the trades as POMO II feeds the system.

If it should be able to gt some momo going south it will be tremendous and another Flash Crash is in store. As for the count, we're either in some massive range bound zig-zag for 2 or somewhere early in 3. I am obviously very bearish, but we have to remain skeptical of the upside surprise (it won't be much). Ben's speech at 10 has given the data another reprieve. 70 to 40 is the range. I can't deliver anything technically that is definitive in either direction. It is in a state that it either breaks 40 and pukes up a lung or it does not.

I'm very comfortable calling the intraday movements and have been delivering some great results at Shanky's Dark Side. To me the only reliable way to play these markets (and I have been on this for a long time now) is trending the 30m charts. That is about the only reliable time frame we have to deal in especially until we leave this range bound crap. I'm not inclined to swing trade much these days.

Thanks for the support and have a great weekend.

Minis this morning are now up 4 and not moving. All that anticipation for a dud? Let's hope not. Halted at 54 resistance. Lord help the day traders if they don't get a gap to trade around this morning.

Minis daily - Range bound from 27 to 42 and channeling down. Sadly at this support level I'm beginning to doubt if the bears can pull it thru. I have little faith in the bulls to be able to mount any sort of significant rally either, thus you get that line in the sand near 70. It has been a fools game for some time now. At least going up it was 100% predictable every morning, now that "they" are losing and the public has left the markets what should be is not reality. I'm not copping out, I'm just stating what I believe reality is. Without the LEH type event they will be able to suspend valuations perpetually and that is what you are witnessing here. More POMO please!

SPX daily chart - I'm real interested in that possible 20/50 bear cross that may be coming soon (orange box). That would not be good for the bulls. On the other hand markets are becoming NT oversold. The bears have not shown the leadership necessary to be able to drag this market down to the levels it deserves. You can't ask for any better data if you are a bear and what has it gotten you this week? 25 points on the minis and a market that is popping on a horrific GDP number. Housing, employment, GDP and a plethora of other bad data continues to be shrugged off. There is no other way to describe this than saying bullshit. Maybe retail is dead and all that is left are the bots controlling the trades as POMO II feeds the system.

If it should be able to gt some momo going south it will be tremendous and another Flash Crash is in store. As for the count, we're either in some massive range bound zig-zag for 2 or somewhere early in 3. I am obviously very bearish, but we have to remain skeptical of the upside surprise (it won't be much). Ben's speech at 10 has given the data another reprieve. 70 to 40 is the range. I can't deliver anything technically that is definitive in either direction. It is in a state that it either breaks 40 and pukes up a lung or it does not.

I'm very comfortable calling the intraday movements and have been delivering some great results at Shanky's Dark Side. To me the only reliable way to play these markets (and I have been on this for a long time now) is trending the 30m charts. That is about the only reliable time frame we have to deal in especially until we leave this range bound crap. I'm not inclined to swing trade much these days.

Thanks for the support and have a great weekend.

Thursday, August 26, 2010

A Simple Chart Or Two - This May Hurt Just A Bit

Fun with Fractals! We're in the blue stage. Gonna be a rough year.

More on the SPX, TNX, USB and VIX relationship. This one is real easy. The VIX should be where the USB is (black line) and the SPX should be where TNX is. It is that simple. Luv me sum VXX. That VIX divergence is NOT foretelling a breakout. It is telling a story of raw manipulation and a lack of real/human market participation. Machines have no fear, especially when they control the markets. Thus, I no longer quote or use the VIX. It has been rendered a useless indicator.

My CPC chart now has the hook. Might need a divergence in NYMO to really set it off. I don't think it stops till extreme bearishness hits at the upper red line.

Bottom line is all hell is gonna break loose.

More on the SPX, TNX, USB and VIX relationship. This one is real easy. The VIX should be where the USB is (black line) and the SPX should be where TNX is. It is that simple. Luv me sum VXX. That VIX divergence is NOT foretelling a breakout. It is telling a story of raw manipulation and a lack of real/human market participation. Machines have no fear, especially when they control the markets. Thus, I no longer quote or use the VIX. It has been rendered a useless indicator.

My CPC chart now has the hook. Might need a divergence in NYMO to really set it off. I don't think it stops till extreme bearishness hits at the upper red line.

Bottom line is all hell is gonna break loose.

Morning Post, SPX, S&P 500, E-mini

470 is the jobs number. What do you think it will be revised to? The minis spiked to 62, basically 18 points off the lows this morning and since the 37 low yesterday that means they are up an astounding 25 points in 24 hours on all this great news! As TD puts it at ZH, "Futures spike immediately as the economy is now losing just around 73k jobs per month instead of the expected 100k, truly a miraculous result. Continuing claims come at 4,456k on expectations of 4,496k, as yet again more unemployed move to the extended ranks: extended rise by 102k and EUC by just under 200k. The US transition to a welfare state continues 300k jobless at a time". I could not have said it better myself.

SPX 30m - I have been showing a few scenarios on the charts. A falling wedge, the head and shoulders and the possible HnS that may just now be putting in a right shoulder.

1) Is price going to backtest the horizontal HnS neckline, possibly fill the gap at 67 today and then GDP sets off the landslide tomorrow.

2) Is the completed downward slanting HnSbacktest complete and we shoot down from the pop this morning?

3) Is the throwunder of the wedge from an oversold (ST) market just now beginning a natural corrective process that may take it as high as 80? (I like 70 max.)

The 30 and 60m charts say the corrective is in play. The daily and weekly charts say more weakness to come. My count is that yesterdays low completed 1 of 3 and this is the 2 corrective before the massively impulsive third of a third. We've risen enough at this time to have completed the corrective in my opinion. So, I'm basically saying pop then drop. Let's see if this wedge can reach it's targets today (70ish) and then digest what the reaction to the horrendous (as far as any normal person would anticipate) GDP numbers will be. One problem I have is that for this market to really take off south there needs to be some sort of LEH type catalyst. Having everything crumbling down around us and the knowledge that nothing good at all can happen is not enough apparently to erode confidence in the markets. When that event happens it will get really fugly. As for upside potential there is no catalyst other than surprise data that is slightly better than horrible (which this market has proven to just adore).

We all know we're playing with a rigged deck and that makes my job that much harder. I have to remain committed to my 30m chart. The divergences on it and the 15m (unfortunately ignored by me yesterday) nailed the bottom and screamed buy at the low. The 40 level of support was another big hint. Those indicators will all be overbought after the open this morning. The 30m minis look nasty with a massive overthrow of diverging indicators which is very bearish. The pop to 61 resistance may have been it, but don;t count out the PPT and Team Bernanke. If, somehow if, price can crack that 40 level (I suspect it will on a big candle with a gap possibly) then we can talk about some serious downside to the 00 level. Till then we have to play "their" games.

GL out there and thanks for the views and support.

SPX 30m - I have been showing a few scenarios on the charts. A falling wedge, the head and shoulders and the possible HnS that may just now be putting in a right shoulder.

1) Is price going to backtest the horizontal HnS neckline, possibly fill the gap at 67 today and then GDP sets off the landslide tomorrow.

2) Is the completed downward slanting HnSbacktest complete and we shoot down from the pop this morning?

3) Is the throwunder of the wedge from an oversold (ST) market just now beginning a natural corrective process that may take it as high as 80? (I like 70 max.)

The 30 and 60m charts say the corrective is in play. The daily and weekly charts say more weakness to come. My count is that yesterdays low completed 1 of 3 and this is the 2 corrective before the massively impulsive third of a third. We've risen enough at this time to have completed the corrective in my opinion. So, I'm basically saying pop then drop. Let's see if this wedge can reach it's targets today (70ish) and then digest what the reaction to the horrendous (as far as any normal person would anticipate) GDP numbers will be. One problem I have is that for this market to really take off south there needs to be some sort of LEH type catalyst. Having everything crumbling down around us and the knowledge that nothing good at all can happen is not enough apparently to erode confidence in the markets. When that event happens it will get really fugly. As for upside potential there is no catalyst other than surprise data that is slightly better than horrible (which this market has proven to just adore).

We all know we're playing with a rigged deck and that makes my job that much harder. I have to remain committed to my 30m chart. The divergences on it and the 15m (unfortunately ignored by me yesterday) nailed the bottom and screamed buy at the low. The 40 level of support was another big hint. Those indicators will all be overbought after the open this morning. The 30m minis look nasty with a massive overthrow of diverging indicators which is very bearish. The pop to 61 resistance may have been it, but don;t count out the PPT and Team Bernanke. If, somehow if, price can crack that 40 level (I suspect it will on a big candle with a gap possibly) then we can talk about some serious downside to the 00 level. Till then we have to play "their" games.

GL out there and thanks for the views and support.

Wednesday, August 25, 2010

Morning Post, SPX, S&P 500, E-mini

Not good. Not much for me to say or speculate on other than how bad is the fall gonna be. The probability of a flash crash this week is enormous. The probability of any sort of noteworthy upside surprise is remote at best (unless they really massage those employment or GDP numbers). We're going down and fast and where she stops nobody knows. SPX near 1040 and DOW near 10040 means they will not approach the round levels at the same time.NASDAQ is at 2123, so it's round level is in reach. RUT, the leader, took out and backtested 600 yesterday.

Minis set lower lows but holding support at the 43 level and riding the neckline of the HnS right now. When this level goes I see nothing to stop it before 1000. I like the 990 level as the stopping point for this first leg down. The big deal today will be who comes in to support the market will the PPT, how strong and at what levels? Where do they bring out the big gins for the latest stick save you know is coming?

Economic Calendar - New Home Sales at 10 and Petrol at 10:30. tomorrow and Friday are really big days. I expect some severe blatant lies form the data manipulators on either the jobs number, GDP or both.

SPX Daily -The MACD is the tell. RSI14 lower low and not setting a divergences is not good either. Price will open out of the lower BB which has the chance to temper the sell off (Last three times a move below the lower BB has generated a correction), but I am not so sure it will this time. Price is also (if that wedge is right) possibly underthrowing that blue wedge. The lack of volume yesterday was quite amusing. I learned on Monday when I thought the market would recover and correct somewhat just how strong the bears are now (or that simply there are no greater fools left to buy the markets). getting a grip on the reality of everything we've been discussing for over a year staring you in the face is a bit overwhelming. Being right and having proven all the government's lies and fraudulent actions true makes it even worse. Honestly, it is a bit scary.

Not gonna chart you to death this morning cause it normally would be as simple as a battle near all those round levels I mentioned earlier, but I don't think the bulls have a chance. They are out of ammo. They have noting left other than pure manipulation of the markets. Merrill bought it all at the the bottom yesterday to support the market, got it to turn and then sold it all at the close. No one wants to be left holding the bag on this one.

When the DOW crosses 10,000 there may be some severe psychological damage that carries thru to the jobs number tomorrow and then GDP in Friday. I like the 975 SPX level for the lows of this fall. The global shock wave should be pretty severe. Tune in to Shanky's Dark Side where I post intraday charts and try to call all the twists and turns.

Thanks for the views and support.

Minis set lower lows but holding support at the 43 level and riding the neckline of the HnS right now. When this level goes I see nothing to stop it before 1000. I like the 990 level as the stopping point for this first leg down. The big deal today will be who comes in to support the market will the PPT, how strong and at what levels? Where do they bring out the big gins for the latest stick save you know is coming?

Economic Calendar - New Home Sales at 10 and Petrol at 10:30. tomorrow and Friday are really big days. I expect some severe blatant lies form the data manipulators on either the jobs number, GDP or both.

SPX Daily -The MACD is the tell. RSI14 lower low and not setting a divergences is not good either. Price will open out of the lower BB which has the chance to temper the sell off (Last three times a move below the lower BB has generated a correction), but I am not so sure it will this time. Price is also (if that wedge is right) possibly underthrowing that blue wedge. The lack of volume yesterday was quite amusing. I learned on Monday when I thought the market would recover and correct somewhat just how strong the bears are now (or that simply there are no greater fools left to buy the markets). getting a grip on the reality of everything we've been discussing for over a year staring you in the face is a bit overwhelming. Being right and having proven all the government's lies and fraudulent actions true makes it even worse. Honestly, it is a bit scary.

Not gonna chart you to death this morning cause it normally would be as simple as a battle near all those round levels I mentioned earlier, but I don't think the bulls have a chance. They are out of ammo. They have noting left other than pure manipulation of the markets. Merrill bought it all at the the bottom yesterday to support the market, got it to turn and then sold it all at the close. No one wants to be left holding the bag on this one.

When the DOW crosses 10,000 there may be some severe psychological damage that carries thru to the jobs number tomorrow and then GDP in Friday. I like the 975 SPX level for the lows of this fall. The global shock wave should be pretty severe. Tune in to Shanky's Dark Side where I post intraday charts and try to call all the twists and turns.

Thanks for the views and support.

Tuesday, August 24, 2010

How Bad Is It?

Well, let's start with the Third Hindenburg Omen Confirmation I could stop there, but why bother? It is so much fun these days picking apart our failed government and the despicable crooks in the Fed and Treasury. Hell, even the MSM is getting in on the act now (well, not including CNBS of course). LOL, like anyone is watching the MSM anymore 'CBS Evening News' Ties All-Time Low.

When you take away the sugar infusion, you get a crash like in the Existing Home Sales Plunge 27.2%, Record Drop, Trounce Expectations Of 13.4%, Lowest Number Since May 1995. Great job Ben and Barry getting all those suckers to come in and suck up some inventory at inflated prices and interest rates! I mean, can't you people find a better way to stimulate (STIMULATE I said) the economy? I guess not. When you apply the $25 trillion defibrillator and nothing happens, you may get the CLUE that the patient is dead. Mouth to mouth, uh, no thanks. I prefer to remain dead and not experience the economic destruction ya'll have created.

I seriously doubt you'll hear this from the BS BLS (or any other government sponsored data provider), but 3rd Quarter GDP Likely Negative, Recession Never Ended. Mish with a little joke here, "The ECRI is still touting the "flattening" of the Weekly Leading Indicators (WLI) at -10. With the collapse in treasury yields, a print of -500,000 on weekly claims, and a god-awful Philly Fed report, let's watch the next few weeks. I suspect this "flattening" period will soon be over." Get it? I thought so.

Can you believe that people have theaudacity, nerve, balls to point out that the markets REALLY are manipulated? Well, it does not take balls but it does take brains to explain it in a way we all can get it. Sadly Denninger's post like all other blogger (read sensible and concise) complaints fall on death bought an paid for ears in Washington. The big brain posted When Will We See Handcuffs? (Market Manipulation). "For those of us who are in the 99% of investors and traders you need to consider carefully how you can reasonably invest or trade in what is increasingly being documented as a rigged casino with willfully-blind "regulators" that have and continue to refuse to enforce both the letter and spirit of the law that is supposed to protect your right to fair dealing and equal market access?" Thank you Karl. I agree, all those SOB's need to be locked up and the key should be thrown away.

You know I preach global default as the only way out of all this mess. Remember back in '08 when all the talk about a dollar crash and a global currency was floating around? Well, this post from The Economic Collapse brings those thoughts full circle and even closer to reality. In Bancor: The Name Of The Global Currency That A Shocking IMF Report Is Proposing you get (what I call) the perverse speculation of the IMF on what will happen down the road and how our currency will be impacted.

Get this, "So where in the world did the name "Bancor" come from? Well, it turns out that "Bancor" is the name of a hypothetical world currency unit once suggested by John Maynard Keynes. Keynes was a world famous British economist who headed the World Banking Commission that created the IMF during the Breton Woods negotiations." Keynes? Hmmm..let me start putting the pieces together, Breton Woods, CFR, Bernanke, bubble, monetization, Keynes, IMF....Let me be the first to say, "NO THANK YOU". This is all hypothetical until you start taking a dose of reality a day and get the real picture. We have to ask (staring down the barrel of the gun) what the hell is their plan from this point to get out of this mess? Just what are these fuckers planning to solve all that they have fucked up? That is a horrifying thought isn't it?

To follow up that lovely thought, Jesse's Cafe American posted US Money Supply Figures: Dude, Where's My (Monetary) Deflation? "There is also sufficient room for concern about the US dollar and its sustainability as the world's reserve currency. This would be familiar to most economists as Triffin's Dilemma. As the world shifts from the Bretton Woods II compromise to a less dollar specific regime the adjustment could be quite traumatic, especially to the financialization industry. Here is another description of the same phenomenon called the Seigniorage Curse. It is why I have called the US dollar and its associated bonds The Last Bubble." Fuck, there is Breton Woods again. This is soooo Alex Jones. Hogwash, right? You better start thinking twice about that. Who the hell got bailed out and who controls all the chips in this crisis? Bond bubble? You betcha and it will be the last bubble. No mas, baby, This will be it, and the "they" that I have been referring to since the early days of this blog will control everything.

We all remember the movie the Minority Report. You know the pre-crime all that futuristic mumbo-jumbo that could never come true? Well, just like Big Brother welcome to Pre-Crime Technology To Be Used In Washington D.C. (Note to my handler - since I am now positive you know what I will be doing next week and for the rest of my life before I do - if you are going to pick me up make it on a Wednesday please - duh - sure you knew that, sorry.) "The technology sifts through a database of thousands of crimes and uses algorithms and different variables, such as geographical location, criminal records and ages of previous offenders, to come up with predictions of where, when, and how a crime could possibly be committed and by who." Nice, without sounding racist, this sounds like something that would have come from the Bush/Cheney cabal and not Barry's administration.

So, how many of you agree with me that we'll need increased border control to keep people IN the country? So, let's not push that border control issue to hard for another year or two. We may want all the holes we can get.

Thanks for the views and support and GL! Remember your seeds, vespas and ammo!

When you take away the sugar infusion, you get a crash like in the Existing Home Sales Plunge 27.2%, Record Drop, Trounce Expectations Of 13.4%, Lowest Number Since May 1995. Great job Ben and Barry getting all those suckers to come in and suck up some inventory at inflated prices and interest rates! I mean, can't you people find a better way to stimulate (STIMULATE I said) the economy? I guess not. When you apply the $25 trillion defibrillator and nothing happens, you may get the CLUE that the patient is dead. Mouth to mouth, uh, no thanks. I prefer to remain dead and not experience the economic destruction ya'll have created.

I seriously doubt you'll hear this from the BS BLS (or any other government sponsored data provider), but 3rd Quarter GDP Likely Negative, Recession Never Ended. Mish with a little joke here, "The ECRI is still touting the "flattening" of the Weekly Leading Indicators (WLI) at -10. With the collapse in treasury yields, a print of -500,000 on weekly claims, and a god-awful Philly Fed report, let's watch the next few weeks. I suspect this "flattening" period will soon be over." Get it? I thought so.

Can you believe that people have the

You know I preach global default as the only way out of all this mess. Remember back in '08 when all the talk about a dollar crash and a global currency was floating around? Well, this post from The Economic Collapse brings those thoughts full circle and even closer to reality. In Bancor: The Name Of The Global Currency That A Shocking IMF Report Is Proposing you get (what I call) the perverse speculation of the IMF on what will happen down the road and how our currency will be impacted.

Get this, "So where in the world did the name "Bancor" come from? Well, it turns out that "Bancor" is the name of a hypothetical world currency unit once suggested by John Maynard Keynes. Keynes was a world famous British economist who headed the World Banking Commission that created the IMF during the Breton Woods negotiations." Keynes? Hmmm..let me start putting the pieces together, Breton Woods, CFR, Bernanke, bubble, monetization, Keynes, IMF....Let me be the first to say, "NO THANK YOU". This is all hypothetical until you start taking a dose of reality a day and get the real picture. We have to ask (staring down the barrel of the gun) what the hell is their plan from this point to get out of this mess? Just what are these fuckers planning to solve all that they have fucked up? That is a horrifying thought isn't it?

To follow up that lovely thought, Jesse's Cafe American posted US Money Supply Figures: Dude, Where's My (Monetary) Deflation? "There is also sufficient room for concern about the US dollar and its sustainability as the world's reserve currency. This would be familiar to most economists as Triffin's Dilemma. As the world shifts from the Bretton Woods II compromise to a less dollar specific regime the adjustment could be quite traumatic, especially to the financialization industry. Here is another description of the same phenomenon called the Seigniorage Curse. It is why I have called the US dollar and its associated bonds The Last Bubble." Fuck, there is Breton Woods again. This is soooo Alex Jones. Hogwash, right? You better start thinking twice about that. Who the hell got bailed out and who controls all the chips in this crisis? Bond bubble? You betcha and it will be the last bubble. No mas, baby, This will be it, and the "they" that I have been referring to since the early days of this blog will control everything.

We all remember the movie the Minority Report. You know the pre-crime all that futuristic mumbo-jumbo that could never come true? Well, just like Big Brother welcome to Pre-Crime Technology To Be Used In Washington D.C. (Note to my handler - since I am now positive you know what I will be doing next week and for the rest of my life before I do - if you are going to pick me up make it on a Wednesday please - duh - sure you knew that, sorry.) "The technology sifts through a database of thousands of crimes and uses algorithms and different variables, such as geographical location, criminal records and ages of previous offenders, to come up with predictions of where, when, and how a crime could possibly be committed and by who." Nice, without sounding racist, this sounds like something that would have come from the Bush/Cheney cabal and not Barry's administration.

So, how many of you agree with me that we'll need increased border control to keep people IN the country? So, let's not push that border control issue to hard for another year or two. We may want all the holes we can get.

Thanks for the views and support and GL! Remember your seeds, vespas and ammo!

Morning Post, SPX, S&P 500, E-mini

Not sure where to start this morning. How about, LOOK OUT! How about, one at a time thru the exits please. How about, bulltards take it up the ass (for all the times those assholes reamed us bears during the 2009 CORRECTION). How about, this is really not funny anymore. How about, we take our government back and throw all the special interest lobbies to the curb, remove the Fed, install some real regulation and restore the Constitution! I got a feeling we're about to get our final wake up call and the government will not be able to hide behind all the lies and fraud any longer. The real truth is about to come out. Oh yea, and you will be considered a racist if you complain about anything Barry has done so get use to it.

Well, the Hindenburg Omens, all those bearish posts below, all the failing economic data - we're beginning to see it all come together. Why the heck do you think I have some smiling dude selling seeds on the site? This depression is real and it is about to get a lot worse. We are YEARS form putting this behind us

/ES- minis 60m - this is the best chart I have for this morning. Price has fallen to the wedge target line (of the last corrective) and it is also backtesting the top diagonal of the fall from the highs in April. That is all good cause the market needs all the help it can get right now as this is also completing the right shoulder of the HnS.

SPX weekly, I'm thinking conservatively 950 target at this time for the first leg of the fall.

CNBS is quite hilarious this morning. Scrambling for anything positive. Pathetic. So our markets are next in line as the global dominoes tumble. Not sure how many times this makes it around the globe. I can't really speculate on what or how far we fall. Everything us premabears have been screaming about for over two years now is about to get cranked up.

So, is this the dreaded third of a third? Sure looks like it as far as the relationship with the HnS and jobs and GDP coming. I do not think this is the market pricing in GDP or anything like that. Those numbers will only add fuel to the fire later this week. Targets - after we crack the 1050 level we retest the lows near 1000, We need to get the DOW thru 10,000 as well, so expect a fight there.

GL and get your seeds and ammo while they are still available.

Well, the Hindenburg Omens, all those bearish posts below, all the failing economic data - we're beginning to see it all come together. Why the heck do you think I have some smiling dude selling seeds on the site? This depression is real and it is about to get a lot worse. We are YEARS form putting this behind us

/ES- minis 60m - this is the best chart I have for this morning. Price has fallen to the wedge target line (of the last corrective) and it is also backtesting the top diagonal of the fall from the highs in April. That is all good cause the market needs all the help it can get right now as this is also completing the right shoulder of the HnS.

SPX weekly, I'm thinking conservatively 950 target at this time for the first leg of the fall.

CNBS is quite hilarious this morning. Scrambling for anything positive. Pathetic. So our markets are next in line as the global dominoes tumble. Not sure how many times this makes it around the globe. I can't really speculate on what or how far we fall. Everything us premabears have been screaming about for over two years now is about to get cranked up.

So, is this the dreaded third of a third? Sure looks like it as far as the relationship with the HnS and jobs and GDP coming. I do not think this is the market pricing in GDP or anything like that. Those numbers will only add fuel to the fire later this week. Targets - after we crack the 1050 level we retest the lows near 1000, We need to get the DOW thru 10,000 as well, so expect a fight there.

GL and get your seeds and ammo while they are still available.

Monday, August 23, 2010

Morning Post, SPX, S&P 500, E-mini

So Iran is now green and nothing eventful happened over the weekend (except for Northern Little League from Columbus, Ga winning their game Saturday at the Little League world Series). I assume most of you have read the past two posts from this weekend. Not much for me to bang on this morning so let's get right to it. Well, the cloud of Armageddon still hangs as we march towards 12/21/2012 Israel Knesset Member Declares "We Are Preparing For War"

Earnings Calendar - Just a few good ones left like BKC, TOL and my wife's favorite TIF.

Economic Calendar - Other than the usual weekly carnage we have GDP Friday.

Pretty quiet with the minis up 5 after having pulled back to the VWAP at 1074. Friday was pretty disappointing to the bears, and I imagine today (if not this week possibly) will be as well. My 30m charts went buy around 12:00 Friday and they tend to run full cycle. I'm still looking at that uncovered Island Gap at 11117 as a potential target for this pop, but anything above 1097 would truly be a surprise. The bears are winning the battle, but apparently they are going to need an LEH type catalyst. The bulls can pull back, but with 15 straight weeks of outflows there might not be any left (other than the bots of course). The only thing that is screwing up my pop call is the daily MACD which is still pretty bearish.

Minis and the range - There ais the 30m 200ma about halfway sitting on 80 and the top is at 1097. This 30m chart says price should be topping at the open and that any gap that is left on the SPX should get covered. If you see the divergences formed by the recent higher high says the bulls have gotten ahead of themselves this morning.

SPX 30m- no changes from when I posted this Friday. Either it busts here or the right shoulder or just now getting started.

So, I'm leaning to a pop (just like the manipulation team to come in and run it up as much as possible to get some cushion before the jobs number Thursday and GDP number Friday. More M&A talk. Expect a bunch of it to come and for the market to go ape shit every time one is announced. Don't forget the Hindenburg Omen has confirmed. The confusion in the markets is very apparent withe the number of stocks at 52 week highs and lows.

Come and play with us at Shanky's Dark Side where I call it real time. My post of that 30m divergence and the market swing Friday was pretty good.

GL and have a great week!

Earnings Calendar - Just a few good ones left like BKC, TOL and my wife's favorite TIF.

Economic Calendar - Other than the usual weekly carnage we have GDP Friday.

Pretty quiet with the minis up 5 after having pulled back to the VWAP at 1074. Friday was pretty disappointing to the bears, and I imagine today (if not this week possibly) will be as well. My 30m charts went buy around 12:00 Friday and they tend to run full cycle. I'm still looking at that uncovered Island Gap at 11117 as a potential target for this pop, but anything above 1097 would truly be a surprise. The bears are winning the battle, but apparently they are going to need an LEH type catalyst. The bulls can pull back, but with 15 straight weeks of outflows there might not be any left (other than the bots of course). The only thing that is screwing up my pop call is the daily MACD which is still pretty bearish.

Minis and the range - There ais the 30m 200ma about halfway sitting on 80 and the top is at 1097. This 30m chart says price should be topping at the open and that any gap that is left on the SPX should get covered. If you see the divergences formed by the recent higher high says the bulls have gotten ahead of themselves this morning.

SPX 30m- no changes from when I posted this Friday. Either it busts here or the right shoulder or just now getting started.

So, I'm leaning to a pop (just like the manipulation team to come in and run it up as much as possible to get some cushion before the jobs number Thursday and GDP number Friday. More M&A talk. Expect a bunch of it to come and for the market to go ape shit every time one is announced. Don't forget the Hindenburg Omen has confirmed. The confusion in the markets is very apparent withe the number of stocks at 52 week highs and lows.

Come and play with us at Shanky's Dark Side where I call it real time. My post of that 30m divergence and the market swing Friday was pretty good.

GL and have a great week!

Sunday, August 22, 2010

The Tell

See update at the bottom.

Combine this chart with the HnS in the post below and you have a recipe for disaster.

I found this chart rather interesting. What has not happened that should have? VIX divergence, USB spike and the SPX becoming disassociated from the TNX all together with the telling (this time proactive and not reactive) spike in the USB. Volume fading away. My guess is that SPX falls to equilibrium with TNX and the VIX goes ape shit. I'd load up on VXX.

Now, to give the bulls their due, these divergences in the VIX have only crushed the bears recently. Thus, I have begun to believe the VIX at this time has been rendered useless in these manipulated markets. With the virtual certainty of the TNX continuing to fall, SPX should find it's "level" so to speak.

UPDATE: And for those of you that think the foreign markets may effect or relate to ours, the SSEC has gotten a bit ahead of the SPX (might not be as manipulated) and it is showing some nasty divergences and is possibly about to get away from our lovely market. Take a peek at 2008. See any similarities?

Combine this chart with the HnS in the post below and you have a recipe for disaster.

I found this chart rather interesting. What has not happened that should have? VIX divergence, USB spike and the SPX becoming disassociated from the TNX all together with the telling (this time proactive and not reactive) spike in the USB. Volume fading away. My guess is that SPX falls to equilibrium with TNX and the VIX goes ape shit. I'd load up on VXX.

Now, to give the bulls their due, these divergences in the VIX have only crushed the bears recently. Thus, I have begun to believe the VIX at this time has been rendered useless in these manipulated markets. With the virtual certainty of the TNX continuing to fall, SPX should find it's "level" so to speak.

UPDATE: And for those of you that think the foreign markets may effect or relate to ours, the SSEC has gotten a bit ahead of the SPX (might not be as manipulated) and it is showing some nasty divergences and is possibly about to get away from our lovely market. Take a peek at 2008. See any similarities?

Friday, August 20, 2010

Weekend Post

Two schools of thought 1) we wake up Monday and it has tanked or 2) the bears have some more pain to endure. There are two possible HnS patterns that back up both cases. This 30m chart (I was about 30m early posting it today on the Dark Side) set some nice divergences that should not be ignored. The sellers could not push price thru 65 support. Almost every time that sellers have lost momo and price had had a chance to consolidate the bulls PPT has been able to come in and push price back up.

So - The blue HnS below has a possible RS forming from this point and the black HnS is completed (same head as the blue one) and is at the neckline. Either way it does not look good. I'm inclined to favor the blue scenario given the position of the oversold markets. That black wedge has completed an A-E formation and may be the catalyst for the right shoulder. Price may stay in the black wedge or breakout to near the target close to the 61% retracement. Either way we have two scenarios that both lead down in a big way.

UPDATE: Either way, the drawn out or immediate, they boht work just fine with the Second Hindenburg Omen Confirmation In As Many Days, Third H.O. Event In One Week and actually telegraph the HO quite well.I believe a trigger is necessary and what is a little freaky about TA is that it at times appears to have a predictive ability. Don't be surprised to see a break of the neckline occur on the same day as the possible catalyst.A rather feisty Denninger covers the HO in this post Oh The Huge Manatee! (Hindenburg Omen) This quote gives an accurate description of what is expected from the HO, "However, the probability of a greater than 5% move to the downside (from the date of the confirmation) exceeds 70% within the next 120 days (four months); the odds of a panic selloff (defined as a rapid 10% or greater decline) is about 40%, and the odds of a crash (defined as a 20% or greater rapid decline) is approximately 20%."

RUT on the cliff? Long Term RUT chart showing it's HnS sitting on a LT S/R line. This one is truly on a cliff. If the green line goes, so does the RUT (after a backtest of course). I think that black 200ma should remain as resistance, but that is not a promise.

The minis - Poor little range bound creatures. What a tease when they could not crack 61 this morning. Oversold with divergences. Can they push it back up to that 97 level one more time? This morning I gave the scenario of them falling to test that blue diagonal at 55. Still is a possibility, but more doubtful now. That TL will come into play eventually.

Upside scenario? Well, if it can crack the 97/1100 area with authority, then the 1117 Island Gap is all I'm willing to give it at this time (being very generous to even consider it I think.)

So, some food for thought over the weekend. The charts appear to be confirming the impending doom. Patience will be required to get the trades right. With the two scenarios it can apparently crash at any moment. I personally believe we need another LEH type catalyst. The manipulators are fighting hard and will not quit. We need for them to start turning on each other.

One more thing to get your heart pumping - Flash Crash Squawk call. This is like listening to your favoite college football anouncer replay old great calls before the big game to get you fired up! Enjoy!

This is the typical daily stock market scenario - Bull gets loose and starts rushing everything and the the PPT (people in this case) subdue it and all is well again. Feel free to insert your own scenario. Enjoy.

Have a great weekend. Thanks to all for the views, donations and support. Don't forget The Dark Side where I put it all on the line.

So - The blue HnS below has a possible RS forming from this point and the black HnS is completed (same head as the blue one) and is at the neckline. Either way it does not look good. I'm inclined to favor the blue scenario given the position of the oversold markets. That black wedge has completed an A-E formation and may be the catalyst for the right shoulder. Price may stay in the black wedge or breakout to near the target close to the 61% retracement. Either way we have two scenarios that both lead down in a big way.

UPDATE: Either way, the drawn out or immediate, they boht work just fine with the Second Hindenburg Omen Confirmation In As Many Days, Third H.O. Event In One Week and actually telegraph the HO quite well.I believe a trigger is necessary and what is a little freaky about TA is that it at times appears to have a predictive ability. Don't be surprised to see a break of the neckline occur on the same day as the possible catalyst.A rather feisty Denninger covers the HO in this post Oh The Huge Manatee! (Hindenburg Omen) This quote gives an accurate description of what is expected from the HO, "However, the probability of a greater than 5% move to the downside (from the date of the confirmation) exceeds 70% within the next 120 days (four months); the odds of a panic selloff (defined as a rapid 10% or greater decline) is about 40%, and the odds of a crash (defined as a 20% or greater rapid decline) is approximately 20%."

RUT on the cliff? Long Term RUT chart showing it's HnS sitting on a LT S/R line. This one is truly on a cliff. If the green line goes, so does the RUT (after a backtest of course). I think that black 200ma should remain as resistance, but that is not a promise.

The minis - Poor little range bound creatures. What a tease when they could not crack 61 this morning. Oversold with divergences. Can they push it back up to that 97 level one more time? This morning I gave the scenario of them falling to test that blue diagonal at 55. Still is a possibility, but more doubtful now. That TL will come into play eventually.

Upside scenario? Well, if it can crack the 97/1100 area with authority, then the 1117 Island Gap is all I'm willing to give it at this time (being very generous to even consider it I think.)

So, some food for thought over the weekend. The charts appear to be confirming the impending doom. Patience will be required to get the trades right. With the two scenarios it can apparently crash at any moment. I personally believe we need another LEH type catalyst. The manipulators are fighting hard and will not quit. We need for them to start turning on each other.

One more thing to get your heart pumping - Flash Crash Squawk call. This is like listening to your favoite college football anouncer replay old great calls before the big game to get you fired up! Enjoy!

This is the typical daily stock market scenario - Bull gets loose and starts rushing everything and the the PPT (people in this case) subdue it and all is well again. Feel free to insert your own scenario. Enjoy.

Have a great weekend. Thanks to all for the views, donations and support. Don't forget The Dark Side where I put it all on the line.

Morning Post, SPX, S&P 500, E-mini

LOL, this turned into a morning rant! Enjoy!

Closer and closer we creep towards reality. Slowly the government's veil is becoming more transparent (I use that word with a weeee bit of sarcasm). The load of shit they have been feeding you about a recovery while they have stealthily stolen all the wealth from the country is about to become painfully obvious to all. There is no recovery. There will be no recovery. The revolution is coming. Get prepared. (No, I am not exaggerating).

Our government is totally out of control and survives only to serve the lobby, special interests and the corporate giants. We the sheeple will become We The People once again and take our government back. It will be a long and painful journey, but we will win. We will eliminate the Fed and restore the Constitution. We will take our government back. Now, we may resemble Argentina at it's lows at some point during our battle, but I honestly believe the American spirit will drive us to success. If we do not prevail, three options A) Fascist state or B) Mad Max C) Fucking bail to some island in the Caribbean or Caspian sea. (I still think all the wealthy are going to gravitate to a couple of spots on the globe and leave the rest of the world to rot.)

On to the markets (sorry, no post last night, I had a little pent up frustration to get out there. I feel better now, thank you).

Opex Friday. No news and the bears have the ball. they have been grinding it down the field and yesterday completed a 50 yard bomb to inside the twenty. Question is, can they push it across the goal line or will they have to settle for 3?Then will they get an onside kick to really stick it to the bulls? this is a real possibility. I still think there needs to be some sort of Lehman catalyst to generate real fear (not like that does not exist anyway) and maybe Iran/N. Korea/China/False flag terror event will be it. We do have the elections that everyone keeps looking forward to, but I think the public is so pissed off at the government that this will be a non event for the markets.

/ES - minis set a lower low last night. The blue diagonal is the upper resistance line from the April top. That should be the target and like a magnet I think we get there very soon. Everyone is on edge and it has been proven there is not much "they" can do to stop another Flash Crash event. Be prepared. Any upside will be purely fictional. If you are not one of the ones that has participated in the record setting outflow of capital from the markets you are a moron. Get the hell OUT!

So, be prepared for more weakness. I am not sure when "the" day will come, but it will come. We're close. The slide (avalanche) has started and all it needs now is a little momo or a catalyst to really get it started. Team Fraudulent Manipulation plays dirty and they still have some power (controlling 70% of the trading volume) to stick it to Papa Bear, so be cautious. Like going against the Mob, they don't play bey the rules (actually they have proven they have no regard for the rules). So. keep those stop tight. Don't get overenthusiastic about any of your plays yet. Be prudent and patient. there will be plenty of opportunities for you to make a mint I promise. For more specific calls today visit the Dark Side. At Shanky's Dark Side we have had a fantastic week. If you want to hear my intraday calls or if you would like to review my real time performance, it is there for all to see. All are welcome (while it is still a free site.

GL, thanks for the views and support and have a great weekend!

Closer and closer we creep towards reality. Slowly the government's veil is becoming more transparent (I use that word with a weeee bit of sarcasm). The load of shit they have been feeding you about a recovery while they have stealthily stolen all the wealth from the country is about to become painfully obvious to all. There is no recovery. There will be no recovery. The revolution is coming. Get prepared. (No, I am not exaggerating).

Our government is totally out of control and survives only to serve the lobby, special interests and the corporate giants. We the sheeple will become We The People once again and take our government back. It will be a long and painful journey, but we will win. We will eliminate the Fed and restore the Constitution. We will take our government back. Now, we may resemble Argentina at it's lows at some point during our battle, but I honestly believe the American spirit will drive us to success. If we do not prevail, three options A) Fascist state or B) Mad Max C) Fucking bail to some island in the Caribbean or Caspian sea. (I still think all the wealthy are going to gravitate to a couple of spots on the globe and leave the rest of the world to rot.)

On to the markets (sorry, no post last night, I had a little pent up frustration to get out there. I feel better now, thank you).

Opex Friday. No news and the bears have the ball. they have been grinding it down the field and yesterday completed a 50 yard bomb to inside the twenty. Question is, can they push it across the goal line or will they have to settle for 3?Then will they get an onside kick to really stick it to the bulls? this is a real possibility. I still think there needs to be some sort of Lehman catalyst to generate real fear (not like that does not exist anyway) and maybe Iran/N. Korea/China/False flag terror event will be it. We do have the elections that everyone keeps looking forward to, but I think the public is so pissed off at the government that this will be a non event for the markets.

/ES - minis set a lower low last night. The blue diagonal is the upper resistance line from the April top. That should be the target and like a magnet I think we get there very soon. Everyone is on edge and it has been proven there is not much "they" can do to stop another Flash Crash event. Be prepared. Any upside will be purely fictional. If you are not one of the ones that has participated in the record setting outflow of capital from the markets you are a moron. Get the hell OUT!

So, be prepared for more weakness. I am not sure when "the" day will come, but it will come. We're close. The slide (avalanche) has started and all it needs now is a little momo or a catalyst to really get it started. Team Fraudulent Manipulation plays dirty and they still have some power (controlling 70% of the trading volume) to stick it to Papa Bear, so be cautious. Like going against the Mob, they don't play bey the rules (actually they have proven they have no regard for the rules). So. keep those stop tight. Don't get overenthusiastic about any of your plays yet. Be prudent and patient. there will be plenty of opportunities for you to make a mint I promise. For more specific calls today visit the Dark Side. At Shanky's Dark Side we have had a fantastic week. If you want to hear my intraday calls or if you would like to review my real time performance, it is there for all to see. All are welcome (while it is still a free site.

GL, thanks for the views and support and have a great weekend!

Thursday, August 19, 2010

Morning Post, SPX, S&P 500, E-mini

Jobless Claims 500,000? Hell, we should rally like a beast by the end of the day! Come on, even a permabull has to begin to ask himself these days what the hell is supporting this market. As we all witnessed back in the beginning of the year the SEC will not prosecute M&A "rumors" spread to move individual equities. Since the administration is (has) running out of bullets and this is a freebie for everyone involved, expect more to come. Really, if you were a CEO why buy now when we all know where the markets are headed? Everything will be at fire sale prices in a year.

Economic Calendar - Leading Indicators and Philly fed at 10:00. Those will be interesting. Natgas at 10:30.

Earnings Calendar - DELL, HPQ, ARO and GPS after the close should spice things up a little. I like checking the Earnings Watch feature HERE.

/ES 4hr - What really stands out about this chart? The dominance of RED candles. Also notice the two extended periods of range bound action this month. The weakening indicators confirm what all the red candles are trying to achieve. The INTC news attempted to lift THE WHOLE MARKET this morning, but the jobless numbers took all that back and then some. Why does the news for one move all? Don't say rising tides, cause this is a red tide that I see. So the trend is range bound with one or two big candles up and the rest red candles churning the market down. Looks like intervention fighting off a trend to me.

SPX 60m - Well, the divergences on the 30m indicators are enough to warm your heart, So I thought I would present the 60m chart to really get your blood pressure up. We're getting VERY toppy on a ST indicator basis. The problem with forecasting and me going out on a limb to call a larger impulsive move south lies in the position of daily indicators on the oversold side still. Can this be one of those rare times that the dailys get embedded? The MCAD is still above zero there and falling, so maybe the weakness is still alive and well.

Not sure how the markets react with Opex tomorrow. I'd say heads up at 10:00 for those econ announcements. COMPQ should be the strongest today with the INTC announcement and the HPQ and DELL numbers coming tonight. Watch that one to rally into the close. The 1,100 ot 1097 levels still are upper resistance with 87 on the lower end. Watch the daily 50ma at 89. If that cracks severe weakness is a real possibility. Once this thing finally lets go, it is gonna impulse like mad. So your key levels as I see 'em are 88, 98, 00, 06 and 17.

If 87 cracks 74 would be a good stopping point if not lower down to 65. If 1,100 cracks (you gotta give the manipulation team their due as well) then 06 and/or what should be a quick run up to the Island Top near 17 is something you have to be aware of. I hate the VIX and rarely mention it, but is is bouncing off of MA support. If that holds, the bears are all good. If that cracks the shorties need to get back on the bench.

My bias is strongly to the downside. Why all the caution? Cause the rampant fraud and market manipulation are prominent drivers. When it begins falling it will be impulsive. We're close to that point. It needs a catalyst (Iran.Israel or China/N Korea). Apparently 500k jobs is not enough (WTF?). tomorrow afternoon or Monday should be interesting. All those red candles above on the /ES - that's your tell.

GL!

Economic Calendar - Leading Indicators and Philly fed at 10:00. Those will be interesting. Natgas at 10:30.

Earnings Calendar - DELL, HPQ, ARO and GPS after the close should spice things up a little. I like checking the Earnings Watch feature HERE.

/ES 4hr - What really stands out about this chart? The dominance of RED candles. Also notice the two extended periods of range bound action this month. The weakening indicators confirm what all the red candles are trying to achieve. The INTC news attempted to lift THE WHOLE MARKET this morning, but the jobless numbers took all that back and then some. Why does the news for one move all? Don't say rising tides, cause this is a red tide that I see. So the trend is range bound with one or two big candles up and the rest red candles churning the market down. Looks like intervention fighting off a trend to me.

SPX 60m - Well, the divergences on the 30m indicators are enough to warm your heart, So I thought I would present the 60m chart to really get your blood pressure up. We're getting VERY toppy on a ST indicator basis. The problem with forecasting and me going out on a limb to call a larger impulsive move south lies in the position of daily indicators on the oversold side still. Can this be one of those rare times that the dailys get embedded? The MCAD is still above zero there and falling, so maybe the weakness is still alive and well.

Not sure how the markets react with Opex tomorrow. I'd say heads up at 10:00 for those econ announcements. COMPQ should be the strongest today with the INTC announcement and the HPQ and DELL numbers coming tonight. Watch that one to rally into the close. The 1,100 ot 1097 levels still are upper resistance with 87 on the lower end. Watch the daily 50ma at 89. If that cracks severe weakness is a real possibility. Once this thing finally lets go, it is gonna impulse like mad. So your key levels as I see 'em are 88, 98, 00, 06 and 17.

If 87 cracks 74 would be a good stopping point if not lower down to 65. If 1,100 cracks (you gotta give the manipulation team their due as well) then 06 and/or what should be a quick run up to the Island Top near 17 is something you have to be aware of. I hate the VIX and rarely mention it, but is is bouncing off of MA support. If that holds, the bears are all good. If that cracks the shorties need to get back on the bench.

My bias is strongly to the downside. Why all the caution? Cause the rampant fraud and market manipulation are prominent drivers. When it begins falling it will be impulsive. We're close to that point. It needs a catalyst (Iran.Israel or China/N Korea). Apparently 500k jobs is not enough (WTF?). tomorrow afternoon or Monday should be interesting. All those red candles above on the /ES - that's your tell.

GL!

Wednesday, August 18, 2010

Become Your Own Adviser

Mish tags one of my most near and dear topics, the conflict of interest that exists between your broker's third home and his mistresses BMW or how you are invested. Why Is Bad Advice So Common? "Wall Street does not generally get paid on funds sitting in cash. The second money comes in it is "put to work" earning fees, regardless of the risk-reward setup for the client." READ THAT POST!

You have been warned by me many times since I started this blog. I believe a majority of the advisers don't give a shit about you or your money. It is all about generating fees for the firm and bonuses for them. Bottom line is if you own a mutual fund with the words GROWTH or EQUITY in them right now, you better be hauling ass. "Shanky, but that is part of my broker's diversification strategy." Yeah, diversified to charge you 1% on those assets regardless if you make money or not. Go get a fee based broker or learn how to put it into cash yourself.

You all know I get real emotional on this subject having first hand knowledge of it. I was taught by some of the best how to "annuitize" your assets for my benefit first and not yours. Get the hell out of mutual funds now. Never own another one. No need to. Dump your broker, like that guy on the Scotttrade commercial, I laugh like hell cause It Is REAL! The odds are you have some friend of the family you trust that is some old money kid/adult that could not work anywhere else, got a cushy job so he can play golf three times a week and he's there to bring in assets and probably can't give you the definition of Alpha or Beta. I'll speculate that 25% of the brokers out there are worth having as an adviser (and that is being kind).

"But Shanky, I can't do this on my own." Sure you can. For the next year or two all you need to know are two things, the symbol SH and cash. You invest some in SH to make some money while the market is falling and you take the rest of your cash and put it in coffee cans and bury it in the back yard (some argue gold should be in there and if you like gold that's cool, I still think it crashes with the market and there will be a better entry if you do not own it yet or if you are looking to add to a position). You will eventually need to know the symbol TBT, but that comes in a year or two when inflation hits. See, that's not so tough.

Your broker will continue to preach staying the course, tax avoidance (if that is still an issue), that the markets have averaged X and Y forever, show you some long term chart that ends in 2007 cause he does not have an updated one and he'll also mention your retirement targets and what returns you MUST achieve to get them. You'll be so bombarded with bullshit you don't understand you'll agree with whatever he says just so you can get the hell out of his office. Staying the course is BAD advice now. Getting the hell out of the markets and any fee based asset is good advice.

Do you know where you fit in your broker's book? I'll tell you this, if you do not have seven figures invested in fee generating assets you are not an A client. Clients are rated A thru D. When the markets start crashing and your broker has 2,500 accounts to sell where do you fit in the line of priority? Will you get the call the day of the crash that you got out, will you get the call later that week that you could not get out or that "we're holding on till it recovers" or will you actually have to call your broker? I suggest that you follow the markets and your investments closer than he/she does and have them on speed dial. Don't count on them to call you.

Bottom line is to get the hell out of the markets. Two reasons: 1) they are going to crash and 2) they are rigged. Take an active role in managing your assets. Read, study, educate yourself in what's what and how to invest. The internet is full of wonderful and accurate information to assist you. I'm willing to bet you'll know more about investing than your broker whose done this for a living for many years in little time. Take the tough questions you have to your broker, know the answers you want to hear, figure out why you are not invested accordingly and watch him squirm a while before you fire him. There is no one out there with more interest in your well being than you, so take the bull by the horns. If you do have an honest adviser that is doing you right, thank him/her and refer your friends to them. They will treat you even better.

The time is now. If you do not take a vested interest in your investments you will lose.